Contents

Life in the United Arab Emirates comes with health risks. Ischemic heart disease, stroke, and chronic kidney disease are top causes of death. This shows why having comprehensive critical illness UAE coverage is key.

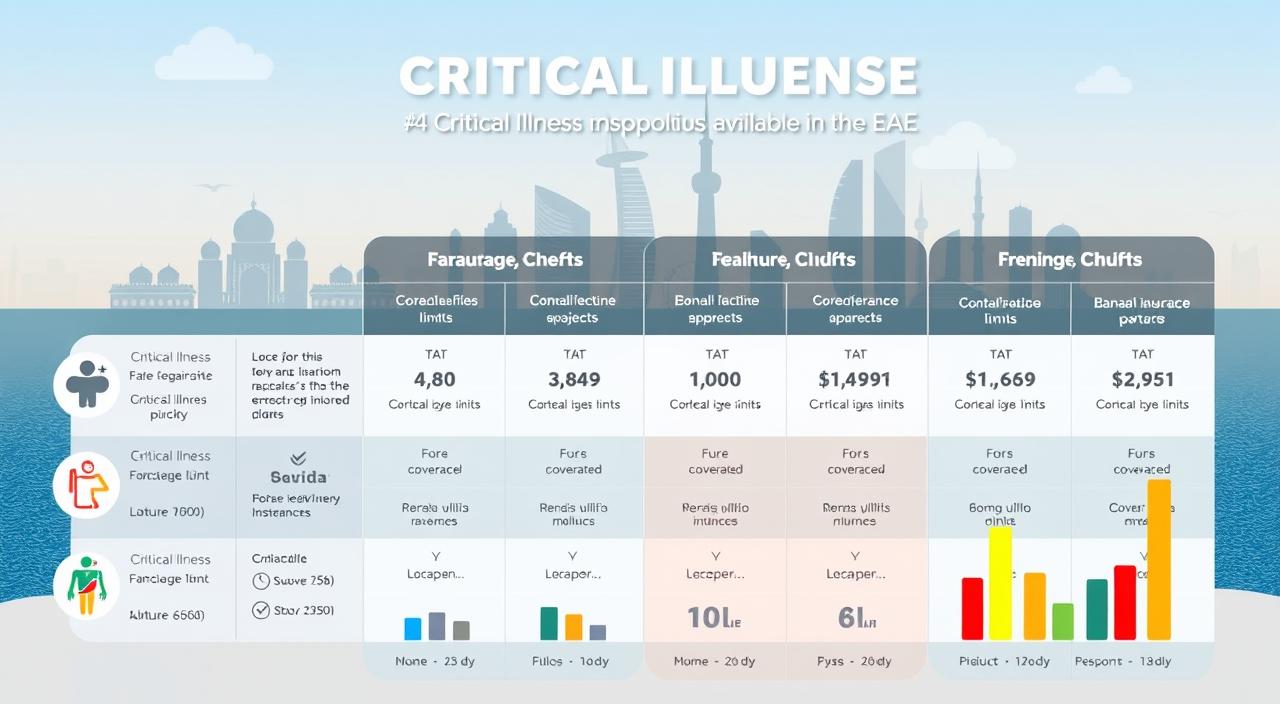

UAE critical illness cover protects you financially against serious diseases. It pays a lump sum if you or a family member gets a critical illness. Full coverage includes over 36 conditions like cancer and heart attacks.

The cost of critical illness insurance in the UAE varies. Premiums can be from AED 200 to AED 2500. Coverage amounts range from AED 200,000 to AED 500,000. Your age, health, coverage, and lifestyle affect these costs.

Despite its benefits, critical illness insurance is often ignored in the UAE. Lack of awareness and misconceptions are reasons. If you have dependents or want financial peace of mind, look into comprehensive critical illness UAE options.

Understanding Critical Illness Insurance

Critical illness insurance is key for financial planning in the UAE. It protects you from serious health issues that can hurt your finances and life.

What Is Critical Illness Insurance?

Term insurance critical illness UAE pays a lump sum if you get a serious illness. It covers 36 major illnesses like cancer and heart attacks. Some plans also cover care for 24 to 72 hours.

Why Is It Important?

Critical illness term life UAE is vital because medical insurance often doesn’t cover enough. It gives you financial safety during health emergencies. It pays for things like travel and surgeries not covered by regular health plans.

Common Critical Illnesses Covered

Expat critical illness cover UAE includes many conditions. Here’s a list of common ones:

| Category | Covered Illnesses |

|---|---|

| Cardiovascular | Heart attack, stroke, by-pass surgery |

| Neurological | Brain surgery, cerebral palsy, Alzheimer’s, Parkinson’s |

| Cancer | Major cancers (specific types may be excluded) |

| Organ-related | Kidney failure, liver failure, specified organ transplants |

Premiums for critical illness insurance in the UAE vary. They can be from AED 200 to AED 2,500. Coverage is usually between AED 200,000 to AED 500,000. Always check policy terms, as pre-existing conditions are often not covered.

Benefits of Having Critical Illness Cover

Critical illness insurance in the UAE is a big help for you and your family. It protects your money when serious health issues come up. Let’s look at why getting affordable critical illness cover UAE is a good idea.

Financial Security During Health Crises

Being told you have a critical illness can be scary. The best plans in the UAE give you money right away. This money helps you not worry about bills or losing your job.

Coverage for Life-Altered Expenses

Critical illness insurance does more than just pay for medical bills. It also covers things like:

- Transportation to treatments

- Childcare during your recovery

- Home modifications for disability

- Debt payments

Access to Better Healthcare

With family critical illness insurance UAE, you get to see the best doctors. Many policies offer:

- Cashless treatment at network hospitals

- Coverage for daycare procedures like dialysis

- Second medical opinions from US specialists

These benefits mean you get the best care when you need it most.

Choosing the right policy is key. Look at different options, read the details, and talk to a financial advisor. This way, you find the best policy for your needs and budget.

How to Choose the Right Policy

Choosing the best critical illness insurance in the UAE is important. It can greatly affect your financial safety during health problems. Let’s look at key points to help you decide wisely.

Assessing Your Needs

First, think about your health risks and money situation. Look at your age, family health history, and lifestyle. This helps you figure out how much coverage you need and what illnesses to protect against.

Comparing Different Insurance Providers

When comparing critical illness insurance in UAE, consider these:

- Coverage for common illnesses like cancer, heart attack, and stroke

- Number of illnesses covered (aim for at least 30)

- Claim settlement ratio

- Waiting periods

- Premium costs

Keep in mind, cheaper options might not cover everything. Look for a balance between cost and coverage.

Reading Policy Fine Print

Read each policy’s terms and conditions carefully. Look at:

- Exclusions and limitations

- Pre-existing condition clauses

- Payout conditions

- Policy renewal terms

Many top plans in UAE offer a 15-day free look. Use this time to check your policy well.

| Factor | Importance |

|---|---|

| Coverage Amount | High |

| Number of Illnesses Covered | High |

| Claim Settlement Ratio | Medium |

| Waiting Period | Medium |

| Premium Cost | High |

By thinking about these points, you can pick a policy that really protects you in the UAE.

Key Features to Look For

When looking for critical illness cover in the UAE, it’s key to know what matters. Your choice can really help during health crises. Let’s look at the main things to think about when picking a critical illness insurance plan.

Coverage Terms and Conditions

Critical illness quotes in the UAE cover many conditions. Look for policies that include big illnesses like cancer, heart attacks, and strokes. Some plans cover up to 64 health issues, including angioplasty and benign brain tumors.

Make sure the policy gives a lump sum payment when you’re diagnosed. This can help a lot with expenses while you’re getting better.

Exclusions and Limitations

It’s important to know what’s not covered in a policy. Most plans don’t cover pre-existing conditions. You can usually add critical illness cover between 18 and 65 years old.

Be aware of waiting periods before coverage starts. Also, some policies might have rules about how severe an illness must be to qualify for a claim.

Premium Costs and Payment Options

The cost of temporary critical illness insurance in the UAE changes based on age, health, and coverage amount. Many insurers offer flexible payment options, like monthly or yearly payments. Some policies start at just ₹615 per month.

Compare different providers to find the best deal. Remember, comprehensive insurance might seem expensive but it’s worth it for the protection it offers.

| Feature | Details |

|---|---|

| Coverage Range | Up to 64 health conditions |

| Entry Age | 18 – 65 years |

| Payment Options | Monthly or Yearly |

| Claim Intimation | Within 30 days of diagnosis |

| Support | 24/7 client services |

The Application Process for Critical Illness Cover

Getting online critical illness insurance in the UAE is easy. The steps are quick and simple. This makes it easy for people in the UAE to get the health protection they need.

Required Documentation

To apply for digital critical illness policies in the UAE, you need a few things:

- Valid identification (Emirates ID or passport)

- Proof of UAE residency

- Medical history records

- Completed application form

Steps in the Application Process

The steps to apply for quick critical illness insurance in the UAE are:

- Choose an insurance provider

- Fill out the online application form

- Submit required documents

- Answer medical questions honestly

- Undergo medical screening (if required)

- Review and accept policy terms

- Pay the premium

Tips for a Smooth Application

To make your application smooth:

- Disclose all pre-existing conditions

- Read the policy document carefully

- Compare different providers’ offerings

- Consider the claim notification period (usually 30 days)

- Check the policy eligibility age range (typically 18-60 years)

Most policies let you cancel in 30 days for a full refund. Premiums are paid yearly. Coverage usually lasts until you’re 65. By following these tips, you can get the right critical illness coverage in the UAE.

Frequently Asked Questions About Critical Illness Cover

Understanding critical illness cover in the UAE can be complex. Let’s address some common questions to help you make informed decisions about your health protection.

How Does It Differ from Other Insurance Types?

Critical illness cover is different from traditional health insurance. It gives a lump sum payment when you’re diagnosed with a covered condition. This is not for paying medical bills directly.

Most policies cover about 36 serious, life-threatening diseases. You can use the money without limits during your recovery.

What Happens After the Diagnosis of an Illness?

After a covered illness is diagnosed, the insurer pays out the agreed sum. This is usually quick, giving you immediate financial help.

Remember, there’s a waiting period before your coverage starts. During critical illness policy renewal in the UAE, check the maximum age for protection. Some policies offer life-long renewability, while others have age limits.

Is Critical Illness Cover Worth the Investment?

Given the high costs of treating critical illnesses in the UAE, this cover is worth it. It acts as a financial lifeline during family crises. It covers expenses that could deplete your savings.

Short-term critical illness UAE policies and group critical illness cover UAE options are available. The earlier you invest, the lower your long-term costs may be. Remember, eligibility in the UAE includes citizens and residents aged 18-59. There are packages tailored to different age groups.