Contents

- 1 Understanding Third-Party Car Insurance in the UAE

- 2 Benefits of Third-Party Car Insurance in the UAE

- 3 Third-Party Car Insurance vs. Comprehensive Coverage

- 4 Key Features of Third-Party Car Insurance Plans

- 5 Factors Affecting Third-Party Car Insurance Premiums

- 6 Third-Party Car Comparison UAE: Top Insurance Providers

- 7 How to Choose the Best Third-Party Car Insurance Plan

- 8 Common Exclusions in Third-Party Car Insurance Policies

- 9 Third-Party Car Insurance Claims Process in the UAE

- 10 Additional Coverage Options and Add-ons

- 11 Tips for Reducing Third-Party Car Insurance Premiums

- 12 Legal Implications of Driving Without Third-Party Insurance

- 13 Future Trends in Third-Party Car Insurance in the UAE

- 14 Conclusion

Driving in the UAE means you must have third-party car insurance. It’s the law. This type of insurance helps protect you from big costs if you’re at fault in an accident. It’s important to know the basics before you start comparing.

Third-party insurance covers damages to other cars, injuries, and even death of people not in your car. It’s cheaper than full coverage but doesn’t offer as much protection. Think about what you need and how much you can spend when looking for a good deal.

The UAE Insurance Authority made this rule in 2007. It makes sure everyone on the road has some protection. But, remember, it doesn’t cover damage to your own car.

To choose wisely, look at what different companies offer. Check their prices and how well they handle claims. This way, you can find the right third-party car insurance for you in the UAE.

Understanding Third-Party Car Insurance in the UAE

Third-party car insurance is key for driving in the UAE. It helps protect drivers and follows local laws. Knowing how it works is important when comparing insurance.

Definition and Basic Coverage

Third-party car insurance in the UAE covers damages to other vehicles or property. It’s a basic liability insurance that doesn’t cover your car. This policy pays for repairs and medical bills if you cause an accident.

Legal Requirements in the UAE

UAE law requires all vehicles to have third-party insurance. This ensures drivers can pay for damages to others. Without it, you face fines and legal trouble.

| Insurance Type | Coverage | Legal Requirement |

|---|---|---|

| Third-Party | Damage to others’ property, Medical expenses for third parties | Mandatory |

| Comprehensive | Third-party coverage plus protection for own vehicle | Optional |

Importance of Third-Party Insurance

Third-party insurance protects you from unexpected accidents. It keeps you from big expenses if you’re at fault. It’s a good choice to meet legal needs and avoid liability claims.

When looking for insurance, compare different providers. Look at coverage, customer service, and claim speed. This helps you choose the best third-party car insurance in the UAE.

Benefits of Third-Party Car Insurance in the UAE

Third-party car insurance in the UAE has many good points. It protects you from being sued if you cause an accident. This is very important because accidents happen a lot here, even with strict rules.

It’s also cheaper than full coverage. This is great for people who don’t want to spend a lot or have older cars.

When looking at the best third-party insurance in the UAE, remember these benefits:

- Legal compliance: It meets the UAE’s minimum insurance law.

- Financial protection: It pays for damages and injuries to others or their property.

- Peace of mind: It gives you legal protection if you damage someone else’s stuff.

- Wide availability: Many companies offer third-party insurance, making it easy to compare.

Third-party insurance doesn’t cover your car’s damage. But, it still helps protect your money from big accident costs.

| Feature | Third-Party Insurance | Comprehensive Insurance |

|---|---|---|

| Third-party liability | Up to AED 3.5 million | Up to AED 5 million |

| Own vehicle damage | Not covered | Covered |

| Premium cost | Lower | Higher |

| Natural disaster coverage | Not included | Often included |

Third-Party Car Insurance vs. Comprehensive Coverage

In the UAE, you must choose between third-party and comprehensive car insurance. It’s important to know the differences. This helps you pick the right option for your needs and budget.

Coverage Differences

Third-party insurance covers damages to others’ property and injuries to third parties. It’s the UAE’s minimum legal insurance. Comprehensive insurance, on the other hand, protects your own vehicle too.

Cost Comparisons

Third-party insurance is cheaper because it offers less coverage. For example, a 2017 Honda City EX 1.5L costs Dh630 to Dh787.50 yearly for third-party. Comprehensive insurance costs Dh1,092 to Dh1680 annually.

Suitability for Different Vehicle Types

The value of your vehicle affects your insurance choice. For older or less valuable cars, third-party might be enough. But for newer or more valuable cars, comprehensive insurance is better.

| Feature | Third-Party Insurance | Comprehensive Insurance |

|---|---|---|

| Legal Requirement | Yes | Exceeds minimum |

| Own Vehicle Damage | No | Yes |

| Third-Party Liability | Yes | Yes |

| Theft Protection | No | Yes |

| Natural Disaster Coverage | No | Yes |

| Cost | Lower | Higher |

When looking at full vs third-party insurance in the UAE, think about your vehicle’s value, budget, and risk level. Third-party insurance meets the law, but comprehensive offers more protection and peace of mind.

Key Features of Third-Party Car Insurance Plans

Third-party car insurance plans in the UAE are very important for drivers. They protect you from financial loss if you damage someone else’s property or hurt them while driving. It’s key to know what these plans offer when you compare them.

These plans cover injuries or death to others and damage to their property. You can use a third-party coverage calculator UAE to see how much you’ll be covered for.

These plans also meet UAE’s legal insurance needs. They are a good choice for many drivers because they are affordable. But, they don’t cover damage to your own car.

| Feature | Coverage |

|---|---|

| Third-Party Bodily Injury | Up to AED 3,500,000 |

| Third-Party Property Damage | Up to AED 2,000,000 |

| Personal Accident Cover | Not Included |

| Own Vehicle Damage | Not Covered |

When you compare third-party policies in the UAE, you’ll see prices change. For example, young drivers in Dubai might pay more. But, if you don’t make any claims, you could get a discount on your premium.

Factors Affecting Third-Party Car Insurance Premiums

When looking for affordable third-party insurance in the UAE, it’s key to know what affects premiums. These factors are important in setting your coverage cost.

Vehicle Type and Value

The type and value of your car affect your insurance price. Luxury and sports cars cost more because of their parts and accident risks. Older cars are cheaper but might need more repairs.

Driver’s Age and Experience

Young drivers in the UAE pay more for car insurance. They are seen as riskier because of less experience. But, older drivers with clean records get lower rates.

Claim History

Your driving record greatly affects your insurance cost. Accidents or tickets raise your premium. But, a clean record can lower your rates.

| Factor | Impact on Premium |

|---|---|

| Luxury/Sports Car | Higher premium |

| Older Car | Lower premium |

| Driver Age < 25 | Higher premium |

| Clean Driving Record | Lower premium |

When comparing car insurance in the UAE, think about these factors. This helps you find the best price. Rates can change between Emirates due to traffic and accidents.

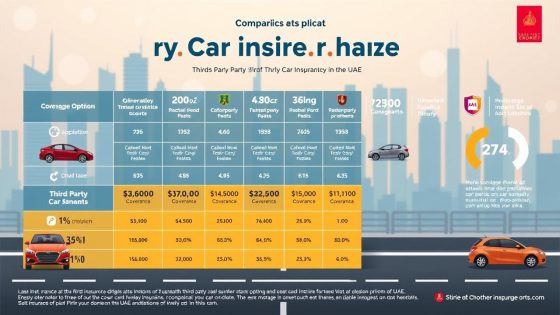

Third-Party Car Comparison UAE: Top Insurance Providers

Finding the best third-party plans in the UAE can be tough. Expats and locals face many options. It’s key to compare plans well.

InsuranceHub is a top pick for comparing third-party plans in the UAE. They show over 76.8% of customers switch to them each year. This saves almost 30% on car insurance bills.

They offer a wide network and tools for easy comparison.

When looking at third-party car insurance plans, think about these things:

- Coverage offerings

- Premium rates

- Claim settlement ratios

- Additional benefits

InsuranceHub’s website, licensed by the Central Bank of UAE, gives instant online quotes. They promise to find the cheapest car insurance in Dubai and the UAE. Over 10,000 customers trust them, saving up to 850 AED per year.

| Provider | Customer Switch Rate | Average Savings | Customer Base |

|---|---|---|---|

| InsuranceHub | 76.8% | 30% | 10,000+ |

| Other Providers | Varies | Up to 23% less | Varies |

While price matters, don’t forget about comprehensive coverage and good customer service. These are important too.

How to Choose the Best Third-Party Car Insurance Plan

Choosing the right third-party car insurance in the UAE is important. You can compare many options with digital tools. These tools help you find the best coverage for your budget.

- Coverage types and limits

- Premium rates (ranging from 3% to 8% of car value)

- No-claim discounts (up to 25%)

- Additional benefits like breakdown services

Platforms like Shory.com offer instant policies and easy comparisons. They work with trusted providers. You can add extra coverage and make smart choices fast.

Always read the fine print. Don’t just look at the price. Check what’s covered and what’s not. For expensive cars or those bought with loans, you might need more than third-party insurance.

| Factors | Consideration |

|---|---|

| Vehicle Value | Higher value may require comprehensive coverage |

| Driver’s Age | Affects premium rates |

| Engine Size | Larger engines may increase premiums |

| Claims History | No claims can lead to discounts |

Use digital tools and think about these points to find the best third-party car insurance in the UAE.

Common Exclusions in Third-Party Car Insurance Policies

Third-party car insurance in the UAE has certain exclusions you need to know. Using a third-party coverage calculator UAE can show you basic coverage. But, it’s important to understand what’s not included.

Personal Injury Coverage

Your injuries or death are not covered by third-party insurance. This policy only covers damages to others, not you. For your own protection, you might need extra coverage.

Own Vehicle Damage

Damage to your car is not covered by third-party policies. If you’re at fault in an accident, you’ll have to pay for repairs. This is a big difference when comparing third-party and comprehensive coverage in the UAE.

Natural Disasters and Acts of God

Third-party insurance doesn’t cover damage from natural disasters like floods or earthquakes. These events are considered “Acts of God” and are usually not included in basic policies.

| Exclusion | Description |

|---|---|

| Off-road Coverage | Accidents occurring in non-designated areas |

| Reckless Driving | Accidents caused by speeding or DUI |

| Unlicensed Drivers | Damages caused by unauthorized drivers |

| Mechanical Failures | Damage due to poor maintenance |

| Acts of War | Damages from terrorism or war |

Remember, third-party insurance is required in the UAE but offers limited protection. Think carefully about your needs when choosing between third-party and comprehensive coverage.

Third-Party Car Insurance Claims Process in the UAE

Filing a claim for third-party car insurance in the UAE is quick and easy. Start by filing a First Information Report (FIR) with the police right after the accident. This is the first step in the claims process.

Then, call your insurance provider as soon as you can. Quick claims comparison UAE shows that fast action helps a lot. Tell them everything about the accident truthfully and clearly.

The claims process changes based on who was at fault. If you caused the accident, the other party will file a claim. If they were at fault, your insurance will handle it. Accident protection comparison UAE data shows this is very important.

| Step | Action | Timeframe |

|---|---|---|

| 1 | File FIR | Immediately after accident |

| 2 | Inform Insurance Company | Within 24 hours |

| 3 | Provide Accident Details | During initial report |

| 4 | Claim Investigation | 1-2 weeks |

| 5 | Claim Settlement | 2-4 weeks (varies by case) |

By following these steps and being honest, you can make the claims process smoother. Quick and accurate reporting is key to handling third-party car insurance claims in the UAE.

Additional Coverage Options and Add-ons

When you look at third-party policies in the UAE, you’ll see many add-ons. These extras can boost your coverage. They help both those who want the best for their luxury cars and those on a tighter budget.

- Personal Accident Cover: Protects you and your passengers in case of injury or death

- Roadside Assistance: Offers help for breakdowns and emergencies

- Windscreen Coverage: Covers repair or replacement of damaged windshields

- Off-Road Recovery: Provides assistance if you get stuck while off-roading

- GCC Cover: Extends your insurance coverage to other Gulf Cooperation Council countries

For those with luxury vehicles, agency repair coverage is key. It makes sure your car is fixed at authorized centers. This keeps its value and performance high. It’s especially good for high-end brands in the UAE.

Think about your driving and car type when picking add-ons. For instance, off-road recovery is vital if you drive in sandy areas. Remember, these extras do cost more. But they can offer great protection. Find the right balance for your needs.

Tips for Reducing Third-Party Car Insurance Premiums

Many UAE drivers want to save on car insurance. Smart strategies can lower your third-party car insurance premiums. You can save money without losing coverage. Let’s look at some ways to cut costs while keeping you protected.

Maintain a Clean Driving Record

A clean driving record can lower your insurance rates. In the UAE, insurers give discounts to drivers with no accidents. Safe driving and avoiding tickets can greatly reduce your premiums over time.

Increase Your Deductibles

Choosing a higher deductible can lower your monthly payments. But, make sure you can pay the deductible if you need to. This is good for drivers who are confident and safe on the road.

Bundle Your Insurance Policies

Many insurers in Dubai offer discounts for bundling policies. Bundling car insurance with home or health insurance can save money. It also makes managing your insurance easier.

| Cost-Saving Strategy | Potential Savings | Considerations |

|---|---|---|

| Clean Driving Record | Up to 20% | Maintain for several years |

| Increased Deductibles | 10-15% | Higher out-of-pocket costs |

| Policy Bundling | 5-10% | Combine with home/health insurance |

| Low Mileage Discount | Up to 15% | For drivers under 10,000 km/year |

Looking for affordable third-party comparison UAE options? Consider older vehicles. Third-party coverage for older cars often has lower premiums. SUV owners can find deals by comparing SUV third-party options in the UAE.

Don’t forget to compare quotes from different providers. Insurance rates can differ a lot. Spending time to research can save you a lot on car insurance in the UAE.

Legal Implications of Driving Without Third-Party Insurance

In the UAE, driving without third-party insurance is against the law. Every car must have at least third-party liability coverage. This rule is key for legal and temporary third-party insurance comparisons.

Driving without insurance brings big penalties. You’ll get a AED 500 fine, 4 black points on your license, and your car might be taken for 7 days. If an accident is fatal, you could owe up to AED 200,000 in blood money.

Driving without insurance also means:

- High repair costs for damages

- Expensive medical bills

- Lawsuits for emotional damages

- Even jail time, depending on the case

Insurance is needed to renew your vehicle’s registration. Policies usually last 13 months. Sites like Shory make getting insurance fast, in under 90 seconds.

For more protection, think about comprehensive coverage. It covers accidents, theft, fire, and natural disasters. Many UAE insurers have affordable comprehensive plans. These plans can make the claims process easier than basic third-party coverage.

| Insurance Type | Coverage | Legal Requirement |

|---|---|---|

| Third-Party Liability | Damages to others | Mandatory |

| Comprehensive | Third-party + own vehicle | Optional (Recommended) |

Stay insured to follow UAE law and avoid legal and financial problems. Remember, temporary third-party comparison UAE can help you find good coverage for short-term needs.

Future Trends in Third-Party Car Insurance in the UAE

The UAE’s third-party car insurance is changing fast. Online tools are making it simpler to find good deals. These tools will grow, giving more detailed comparisons and quick quotes.

Soon, insurance will be based on how you drive. Companies might use devices to track your driving. This could change how much you pay for insurance.

The UAE’s insurance market is focusing more on customers. Insurers will offer policies that you can tailor to fit your needs. This might also happen for motorbike insurance, giving riders options that fit them.

| Trend | Impact |

|---|---|

| Digital Comparisons | Easier policy selection |

| Telematics | Personalized pricing |

| Customization | Flexible coverage options |

These changes will make the UAE’s insurance market better and easier to use. People will have a smoother time picking policies and dealing with claims. The industry is moving towards a digital future.

Conclusion

Third-party car insurance in the UAE is more than a legal must. It’s a key safety net for drivers. When looking at third-party car comparison UAE options, remember it protects you from big financial hits if you harm others on the road.

The maximum settlement for injuries or death of a third party is AED 200,000. This shows how important this protection is.

While third-party insurance is a must and often cheaper, it’s key to know its limits. The best third-party coverage in the UAE might not cover your car or personal injuries. Think about what you need – if you have a new or expensive car, comprehensive insurance might be better, even if it costs more.

The “third party car insurance Dubai price” can change a lot. It depends on your driving experience and car model. Use comparison sites to find good deals, but don’t forget about coverage. Look at each policy’s details to make sure you’re getting the right protection and following UAE law. By choosing wisely, you’ll drive with confidence, knowing you’re safe on Dubai’s busy roads.