Contents

- 1 Understanding Temporary Car Insurance in Abu Dhabi

- 2 Benefits of Choosing Temporary Car Insurance in Abu Dhabi

- 3 Situations Where Temporary Car Insurance is Recommended

- 4 Coverage Options in Temporary Car Insurance Plans

- 5 Factors Affecting Temporary Car Insurance Premiums in Abu Dhabi

- 6 How to Compare Temporary Car Insurance Quotes in Abu Dhabi

- 7 Top Providers of Temporary Car Insurance in Abu Dhabi

- 8 Advantages of Purchasing Temporary Car Insurance Online

- 9 Common Misconceptions About Temporary Car Insurance in Abu Dhabi

- 10 Tips for Choosing the Best Temporary Car Insurance Plan in Abu Dhabi

- 11 Temporary Car Insurance Abu Dhabi: A Comprehensive Guide

- 12 The Future of Temporary Car Insurance in Abu Dhabi

In Abu Dhabi, you must have car insurance to drive. This rule applies whether you own the car or are renting it. Temporary car insurance in Abu Dhabi is a flexible option for short-term needs. It covers you for a few minutes to several months.

Temporary car insurance is great for short-term needs. It’s perfect for learning to drive, renting a car for a trip, or using a friend’s vehicle. These plans are flexible and cost-effective for situations where long-term insurance isn’t needed.

In the UAE, more people are choosing short-term vehicle insurance. Several insurers now offer these options. This shows the growing need for flexible insurance that meets different drivers’ needs in Abu Dhabi.

Understanding Temporary Car Insurance in Abu Dhabi

Temporary car insurance is a flexible and affordable option for drivers. It’s great for those who need coverage for a short time. Whether you live in Abu Dhabi or are just visiting, knowing about temporary motor insurance UAE is key.

Definition of Temporary Car Insurance

Temporary car insurance covers you for a short time, from hours to months. It’s different from yearly policies. It’s perfect for renting a car, borrowing a friend’s, or needing extra coverage for a trip.

How Temporary Car Insurance Differs from Traditional Policies

Temporary car insurance covers you for a short time, unlike yearly policies. This makes it great for short needs. It’s also more affordable for short periods.

But, buying temporary policies often can cost more than a yearly policy. It’s wise to compare costs.

Temporary insurance in Abu Dhabi still offers basic protections. This includes third-party liability, which is required in the UAE. You can also add comprehensive, collision, and personal injury protection to your plan.

| Policy Duration | Traditional Car Insurance | Temporary Car Insurance |

|---|---|---|

| Length of Coverage | 1 year | Few hours to several months |

| Flexibility | Fixed annual term | Customizable duration |

| Cost-Effectiveness | Suitable for long-term needs | Ideal for short-term requirements |

When looking at temporary car insurance in Abu Dhabi, think about what you need. Websites like Veeels.com help you compare prices. This way, you can find the best and most affordable plans.

Understanding temporary car insurance helps you make smart choices. It ensures you’re covered, no matter how short your drive is.

Benefits of Choosing Temporary Car Insurance in Abu Dhabi

Temporary car insurance in Abu Dhabi has many benefits. It’s great for expats, visitors, or anyone needing short-term coverage. It offers protection without the long-term commitment of a regular policy.

Cost-Effective Solution for Short-Term Coverage

Temporary car insurance is very affordable. It’s cheaper than a regular policy for a short time. You can get weekly plans for as low as AED 275 per week.

Flexibility in Coverage Duration

Temporary car insurance is very flexible. You can choose coverage from one week to nine months. This is perfect for short trips or borrowing a friend’s car. You only pay for what you need, without long-term commitments.

| Coverage Duration | Suitable For |

|---|---|

| 1 week | Short trips, renting a car, borrowing a friend’s vehicle |

| 1 month | Extended trips, temporary job assignments, waiting for a new car delivery |

| 3-9 months | Expats, long-term visitors, students studying abroad |

Ideal for Visitors and Expats

Temporary car insurance is great for visitors and expats in Abu Dhabi. It’s perfect for those who don’t need a full year’s policy. You can get comprehensive coverage without long-term commitment.

In Abu Dhabi, all vehicles must have third-party liability coverage. Temporary insurance meets this requirement. It offers flexible plans to fit your needs and budget, giving you peace of mind on Abu Dhabi’s roads.

Situations Where Temporary Car Insurance is Recommended

Temporary car insurance in Abu Dhabi is great for many short-term needs. It’s good for renting cars, borrowing friends’, buying new ones, or selling yours. It gives you the protection and peace of mind you need during these times.

Renting a Car in Abu Dhabi

Choosing temporary insurance when renting a car in Abu Dhabi adds extra protection. It covers you in case of accidents or damages. This way, you won’t face big financial problems.

Borrowing a Friend’s Vehicle

Need to borrow a friend’s car for a bit? Get temporary insurance in Abu Dhabi. It protects you and your friend if something happens while driving. It’s a smart move for both of you.

Purchasing a New Car

Buying a new car? Temporary insurance fills the gap until your long-term policy starts. It lets you drive your new car legally and safely. You’ll be covered until you get a permanent policy.

Selling Your Car

Selling your car? Temporary insurance is a good idea. It covers your car during test drives by buyers. It protects your vehicle and gives buyers peace of mind too.

In the UAE, car insurance is a must for all vehicles, even borrowed ones. Temporary insurance is a smart, affordable choice. It starts at AED 275 per week. It’s perfect for short-term car use without the long-term commitment.

Coverage Options in Temporary Car Insurance Plans

When looking at temporary car insurance in Abu Dhabi, it’s key to know the different coverage options. This ensures you get the right protection for your needs. Plans offer third-party liability, comprehensive, and personal accident coverage.

Third-Party Liability Coverage

Third-party insurance in the UAE is a must-have. It covers costs for damage or injury to others in an accident. This coverage is included in all temporary car insurance plans. It means you’re protected if you’re in an accident and need to pay for others’ damages or injuries.

Comprehensive Coverage

Comprehensive coverage in Abu Dhabi offers more protection. It goes beyond third-party liability and covers theft, fire, and natural disasters. This coverage keeps your vehicle safe from many risks, giving you peace of mind while driving.

| Inclusions | Exclusions |

|---|---|

| Damages from natural disasters | Mechanical or electrical breakdown |

| Severe weather | Wear and tear |

| Theft | Illegal activities |

| Vandalism | Driving under the influence |

| Fire | Nuclear risks |

| Flood | War |

| Glass damage | Fraudulent accidents |

| Self-ignition | Wilful damages |

| Civil disturbance | |

| Damage to third parties |

Personal Accident Coverage

Personal accident coverage in the UAE is a great add-on. It helps with medical costs for you and your passengers in an accident. This coverage means you won’t face high medical bills from an accident. It keeps you and your passengers safe from medical expenses.

When picking a temporary car insurance plan in Abu Dhabi, think about what you need. Choose coverage that fits your needs. Whether it’s third-party, comprehensive, or personal accident, the right protection lets you drive worry-free.

Factors Affecting Temporary Car Insurance Premiums in Abu Dhabi

When looking for temporary car insurance quotes in Abu Dhabi, knowing what affects your premium is key. Insurance companies look at many things to set your short-term coverage cost. Knowing these factors can help you find better deals and discounts for your temporary policy in Abu Dhabi.

Driver’s age is a big factor in temporary car insurance costs. Drivers between 23 and 25 might pay up to 25% more. Drivers between 25 and 30 might pay 15% more. But, drivers over 30 but under 60 might see their rates drop by 10%.

The type of vehicle also matters a lot. The car’s value greatly affects your premium. For example, cars worth between AED 10,000 and AED 300,000 start at 3% insurance. Cars under AED 10,000 cost about 3% to insure. Cars over AED 300,000 cost about 2.75%.

| Car Value (AED) | Average Insurance Rate |

|---|---|

| Less than 10,000 | 3% |

| 10,000 – 300,000 | 3% |

| More than 300,000 | 2.75% |

The type of car you drive also affects your premium. SUVs are more expensive to insure than basic cars. Other factors like driver’s license age, new car status, sports car ownership, and where you register your car can also add costs.

UAE insurance companies also look at your credit history. About 95% of auto insurers in the UAE see credit history as important. A good credit score can help you get better temporary car insurance quotes in Abu Dhabi.

Also, moving to areas with higher speed limits or extreme weather can raise your insurance rates. Higher speed limits mean more accidents, and extreme weather can damage infrastructure, leading to more claims.

Driving behavior is another thing insurers consider. Distracted driving, which is becoming more common, can increase insurance costs. Accidents caused by distracted driving have gone up in the UAE, leading to higher premiums.

Finally, how long you need your temporary car insurance affects your premium. Longer periods cost more. When using an auto insurance calculator for temporary coverage in the UAE, remember the standard deductible is usually 20%.

By understanding these factors and comparing quotes from different providers in Abu Dhabi, you can find the right coverage for you. You might also find discounts that fit your situation.

How to Compare Temporary Car Insurance Quotes in Abu Dhabi

When looking for the best temporary car insurance in Abu Dhabi, comparing quotes is key. This ensures you get good coverage at a fair price. With many insurance companies in the UAE, comparing can be hard. But, there are ways to make it easier and find the right policy for you.

Online Comparison Tools

Online comparison tools are a great way to compare quotes in Abu Dhabi. You just need to enter what you need, like how long you want coverage and what kind of vehicle you have. The tool then shows you quotes from different insurers, so you can see what’s best for you.

Make sure to give accurate info when using these tools. Things like your age and driving history affect your rates. For example, young drivers often pay more because they’re seen as riskier. Also, rates can change based on where you live in Abu Dhabi.

Consulting with Insurance Brokers

Another way to compare quotes is by talking to insurance brokers. They know a lot about insurance and can help you find what’s best for you. They can also give tips on how to get the best deal.

When talking to a broker, share your driving history and what you need from your insurance. This helps them find the right policy for you. Brokers can also help get you a better deal by negotiating with insurers. Just make sure to pick a good and experienced broker.

By using online tools and talking to brokers, you can easily compare temporary car insurance in Abu Dhabi. Look at coverage, rates, and the company’s reputation when choosing. The right insurance lets you drive with confidence, knowing you’re protected.

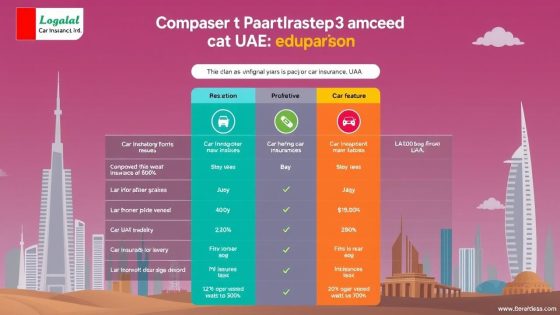

Top Providers of Temporary Car Insurance in Abu Dhabi

In Abu Dhabi, you can pick from many top short-term auto insurance providers. Each offers special coverage and rates to fit your needs.

InsuranceHub is known for its focus on customers and good prices. It has over 10,000 happy customers. They save an average of 30% on insurance bills.

The company makes getting temporary car insurance easy. Its online application is simple, and support is personal.

Union Insurance Company

Union Insurance Company is a top choice in Abu Dhabi. They have many coverage options, like third-party liability and comprehensive plans. They also offer flexible payment plans and extra benefits like roadside assistance.

Al Wathba National Insurance Company (AWNIC)

Al Wathba National Insurance Company (AWNIC) is trusted for short-term auto insurance in the UAE. They have good rates and an easy online platform for quotes and policies. Their plans cover many situations, like renting or borrowing a car.

Abu Dhabi National Insurance Company (ADNIC)

Abu Dhabi National Insurance Company (ADNIC) is a well-known provider in the emirate. They offer full coverage and are known for great customer service. Their plans are good for visitors and expats, with flexible durations and customization.

| Insurance Provider | Key Features | Customer Satisfaction |

|---|---|---|

| InsuranceHub | Competitive pricing, personalized support, easy online application | High |

| Union Insurance Company | Flexible payment plans, additional benefits, comprehensive coverage | High |

| Al Wathba National Insurance Company (AWNIC) | User-friendly online platform, competitive rates, coverage for various situations | Medium to High |

| Abu Dhabi National Insurance Company (ADNIC) | Comprehensive coverage, excellent customer service, flexible plans | High |

When picking a temporary car insurance provider in Abu Dhabi, look at reputation, coverage, prices, and support. Compare quotes from top providers in the UAE to find the best plan for you.

Advantages of Purchasing Temporary Car Insurance Online

In today’s world, buying temporary car insurance online in Abu Dhabi is very popular. It offers many benefits. You can easily compare different quotes online, saving you time and effort.

Online platforms have changed the insurance world. Now, you can buy temporary car insurance online in Abu Dhabi easily. With just a stable internet, you can look at different options, compare them, and buy your policy from home or work. The process is simple and quick, without lots of paperwork.

Another big plus of online temporary auto insurance in the UAE is how fast you can get coverage. Many insurers let you activate your policy right away after you pay online. This is great for visitors or expats who need to drive a car in Abu Dhabi quickly.

| Advantage | Description |

|---|---|

| Convenience | Buy temporary car insurance online in Abu Dhabi from anywhere, anytime |

| Comparison | Compare multiple quotes and coverage options easily |

| Speed | Obtain digital temporary auto insurance in the UAE with instant policy activation |

| Flexibility | Customize coverage options and duration to suit your specific needs |

| Paperless | Minimize paperwork with streamlined online application processes |

Buying temporary car insurance online also gives you flexibility. You can pick the coverage and time you need. This means you only pay for what you really need. Whether it’s for a few days or longer, you can find the right policy for you.

In short, buying temporary car insurance online in Abu Dhabi has many benefits. It’s convenient, fast, flexible, and easy to compare. By using online platforms, you can get the coverage you need quickly and easily. This lets you drive in Abu Dhabi with confidence.

Common Misconceptions About Temporary Car Insurance in Abu Dhabi

There are many myths about short-term auto insurance in Abu Dhabi. It’s important to know the truth to make good choices. Let’s look at some common myths about temporary car insurance in the UAE.

Myth 1: Temporary Insurance is More Expensive

Many think temporary car insurance in Abu Dhabi is pricier than regular policies. But, this isn’t always true. Temporary coverage is cheaper for short needs, with lower costs than yearly policies.

Think about this: if you only need insurance for a month, a temporary policy is cheaper than a yearly one. It’s a smart choice for saving money in Abu Dhabi.

Myth 2: Temporary Insurance Offers Limited Coverage

Some believe temporary car insurance in the UAE has less coverage than regular policies. But, this is a big myth. Temporary plans usually have the same basic protections as yearly policies, including:

- Third-party liability coverage

- Collision coverage

- Comprehensive coverage

- Personal accident coverage

The only difference is how long you’re covered. When you get a short-term auto insurance plan in Abu Dhabi, you get the same protection as a yearly policy.

It’s key to check the details of any temporary car insurance policy. Make sure it fits your needs and offers enough coverage. Don’t let worries about less protection stop you from trying this flexible and affordable option.

By clearing up these myths about temporary car insurance in Abu Dhabi, you can make better choices. Whether you’re renting a car, borrowing a friend’s, or need coverage for a short time, temporary auto insurance can give you peace of mind without costing too much.

Tips for Choosing the Best Temporary Car Insurance Plan in Abu Dhabi

Looking for the right temporary car insurance in Abu Dhabi? It’s important to think about a few key things. This way, you can pick a policy that fits your needs well. Here are some tips to help you choose the best short-term auto insurance.

Assess Your Coverage Requirements

First, figure out what coverage you really need. Think about the car’s value, how you drive, and why you need insurance. For example, renting a car for a trip is different from borrowing a friend’s car for a while.

Knowing what you need helps you pick a policy that’s right for you. This way, you won’t pay too much for things you don’t need.

Consider the Reputation of the Insurance Provider

Choosing a good insurance provider in Abu Dhabi is key. Look for companies known for being reliable, financially stable, and having great customer service. Check out what others say and look into the company’s history.

Choosing a trusted provider means you’ll get help when you need it. You’ll feel more secure knowing you’re in good hands.

Read the Fine Print

Before you buy a policy, read it carefully. Look at the terms, conditions, and what’s not covered. This way, you won’t be surprised if you need to make a claim.

If you’re unsure about anything, ask the provider. They can help clear up any questions you have.

By thinking about what you need, choosing a reputable provider, and reading the policy details, you can make a smart choice. These tips will help you find the best temporary car insurance in Abu Dhabi. You’ll get the coverage you need at a good price.

Temporary Car Insurance Abu Dhabi: A Comprehensive Guide

Temporary car insurance in Abu Dhabi is a popular choice for many drivers. It offers a detailed guide on what it covers, its benefits, and how to pick the best plan for you.

Understanding the Basics

Temporary car insurance in Abu Dhabi is for short-term use. It lasts from one day to several months. It’s great for renting a car, borrowing a friend’s, or buying a new one.

In the UAE, you must have car insurance. Driving without it can lead to big fines, license problems, and even having your car taken away. Temporary insurance keeps you legal and covered for a short time.

Benefits and Drawbacks

Temporary car insurance in Abu Dhabi is cheaper than yearly policies. It’s perfect for short needs. You can also adjust the policy length to fit your needs.

But, there are downsides. You might need to renew it often, which takes time. Some plans might not offer as much as yearly policies.

How to Choose the Right Plan

To find the best temporary car insurance in Abu Dhabi, consider these:

- Think about what coverage you need. Do you want third-party liability, comprehensive, or personal accident?

- Compare prices from different providers. Use online tools or talk to brokers.

- Read the policy details carefully. Know what’s included and what’s not.

The table below shows what three top providers in Abu Dhabi offer:

| Provider | Coverage Duration | Third-Party Liability | Comprehensive Coverage | Personal Accident Coverage |

|---|---|---|---|---|

| GIG Gulf | 1 day to 12 months | Up to AED 3.5 million | Available | Up to AED 20,000 |

| Al Dhafra Insurance | 1 day to 6 months | Up to AED 2 million | Available | Up to AED 15,000 |

| Abu Dhabi National Insurance Company (ADNIC) | 1 day to 3 months | Up to AED 2.5 million | Available | Up to AED 18,000 |

By knowing the basics, weighing the pros and cons, and choosing wisely, you can get the right temporary car insurance for your needs.

The Future of Temporary Car Insurance in Abu Dhabi

Temporary car insurance in Abu Dhabi is set to grow. With over 50 years of experience, insurance companies are ready to meet new needs. They have more than a million happy customers.

Short-term auto coverage is becoming more popular. This trend shows that it will be even more important in the future.

Emerging Trends

Telematics and usage-based insurance are big trends now. Insurers use new tech to offer better, cheaper coverage. This lets drivers pay based on how much they drive.

Potential Changes in Regulations

Regulations might change soon. This could make getting short-term coverage easier and more consistent. It could also make prices fairer.

Insurance companies in Abu Dhabi must keep up with new tech and what people want. By doing this, they can succeed in the growing market for short-term auto coverage.