Do you dream of building your empire in the UAE? Are you curious about the country’s free zones? Look no further! In 1985, the UAE started its first free zone at Jebel Ali Port. This opened the door to over 40 special economic areas across the nation.

These zones welcome many industries, like finance, technology, logistics, and media. They attract international investors who want full control over their businesses.

Find out why the UAE is a global leader. It offers 100% foreign ownership and custom-free trade. This creates a world of opportunities for smart entrepreneurs.

Corporate tax exemptions in free zones apply only to qualified income from regulated activities; businesses earning mainland-sourced income may face federal corporate tax. Ref.: “UAE Ministry of Economy (2024). Free Zones. Ministry of Economy – UAE.” [!]

Understanding UAE Free Zones: Evolution and Purpose

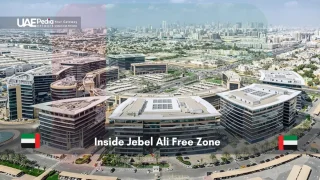

In 1985, the UAE started with the Jebel Ali Port. It was a big step to draw in foreign money and make a place for exports without taxes. Now, the UAE has over 40 free zones, mostly in Dubai. These places are like playgrounds for businesses, aiming to grow the economy, create jobs, and encourage new ideas.

UAE free zones offer special benefits like no taxes, no customs on imports and exports, and their own rules. It’s like getting the best of both worlds in the UAE. Zones like Jebel Ali Free Zone (JAFZA) and Dubai Multi Commodities Centre (DMCC) focus on different areas, offering special licenses and setups.

The UAE keeps investing in free zones to be a top business spot. Over 150,000 companies are here, making billions in exports each year. Businesses get perks like owning 100% of their company, tax breaks for 15 years, and no duties on imports and exports.

UAE free zones keep getting better to meet the world’s changing needs. They offer many options for different industries and focus on new ideas. This makes the UAE a great place for business growth and a top choice for entrepreneurs and investors.

Check out the below:

Investment in UAE Free Zones: Benefits and Incentives

Investing in UAE free zones is exciting for businesses. You get tax breaks and easy operations. It’s like finding a treasure chest!

Tax Benefits and Financial Advantages

The tax benefits in UAE free zones are amazing. You might not have to pay corporate tax. Plus, importing and exporting is easy. You can own 100% of your business. No local sponsor is needed. This is a big change!

Custom-free trade applies only to imports/exports directly linked to licensed activities; personal goods or non-zone destined shipments may incur standard customs duties. Ref.: “The Official Portal of UAE Government (2024). Starting a business in a free zone.” [!]

Operational Advantages

You face less red tape and get licenses fast. It’s like a breeze. These zones have top-notch facilities. Your business will run smoothly. It’s like the UAE welcomed you with open arms!

Strategic Benefits

UAE free zones offer more than just practical benefits. They have over 40 zones for different industries. You can find the perfect one for your business. From tech to logistics, there’s a zone for you. With help from experts like Europe Emirates Group, setting up is easy.

Jebel Ali Free Zone (Jafza) generates $169 billion in annual trade value with 10,700+ businesses, demonstrating high ROI potential for logistics and trading ventures. Ref.: “Jebel Ali Free Zone (2024). Jafza Impact Report.” [!]

| Key Benefits of UAE Free Zones | Details |

|---|---|

| Tax Incentives | Corporate tax exemptions, custom-free imports and exports |

| Operational Advantages | 100% foreign ownership, streamlined business setup, state-of-the-art infrastructure |

| Strategic Benefits | Specialized ecosystems for various industries, expert guidance from service providers |

So, what are you waiting for? Get ready for an investment adventure in UAE free zones. With these great benefits, your business will soar!

Setting Up Your Business in UAE Free Zones

Ready to start your business in the UAE’s free zones? It’s an exciting journey! First, choose the best free zone for you. With over 40 options, it’s like picking your favorite ice cream.

After picking your zone, decide what your business will do. Will you sell things, offer services, or something else? This choice will help you get the right license.

| Free Zone | Capital Requirement | Key Benefits |

|---|---|---|

| DMCC | AED 1 million | 100% foreign ownership, 0% corporate tax, easy setup |

| KIZAD | AED 150,000 | Tax exemptions, logistics hub, integration with Khalifa Port |

| Masdar City | AED 500,000 | Focus on sustainability, access to R&D facilities |

Now, it’s time to register your business. This step is very important! You’ll need to get a business license, find office space, and sort out visas.

Visas are important too. The number of visas you can get depends on your office size. So, think big for your office if you plan to grow. Each free zone has its own rules, so learn them well.

Visa quotas directly correlate with office size: Hamriyah Free Zone allows 1-7 visas without physical offices, while warehouse operations support up to 50 visas. Ref.: “BizStartUAE (2024). Latest Hamriyah Free Zone Visa Regulations.” [!]

Starting a business in a UAE free zone is like playing a game. You’re the hero, and you’ll discover the rules as you go. With a good plan and some courage, you’ll succeed soon!

Popular Free Zone Industries and Investment Sectors

The UAE’s free zones offer many business chances. They have more than just oil and gas now. Construction and real estate are growing fast.

Hotels and hospitality welcome many visitors. Logistics and finance keep things running smoothly. Healthcare and retail are also booming.

Fintech, crypto, and IT are growing fast. They are like stars exploding in the sky!

There’s a great place for your business to thrive in the UAE. Jebel Ali Free Zone (Jafza) has over 10,000 companies. Hamriyah Free Zone Authority (HFZA) is also very big.

The UAE’s free zones have many business activities and investment sectors. It’s like finding your perfect match online. The chances for success are huge!

So, if you’re an exporter, trader, or investor, free zones are great. They have no taxes, easy rules, and protect your ideas. The GRG UAE Free Zones help your business grow.