Contents

- 1 Understanding Comprehensive Car Insurance in the UAE

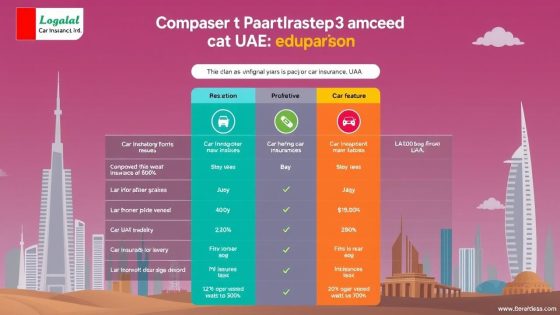

- 2 Comprehensive Plans Comparison UAE: Key Factors to Consider

- 3 Top Insurance Providers for Comprehensive Coverage

- 4 Comparing Premium Rates Across Providers

- 5 Coverage Limits and Third-Party Liability

- 6 Additional Benefits and Add-ons

- 7 Claims Process and Customer Support

- 8 Customization Options for Different Vehicle Types

- 9 Comprehensive vs. Third-Party Insurance: A Detailed Comparison

- 10 Digital Tools for Easy Comparison and Purchase

- 11 Factors Affecting Comprehensive Insurance Premiums

- 12 Special Considerations for Luxury and High-Value Vehicles

- 13 Understanding Policy Terms and Conditions

- 14 Tips for Renewing Comprehensive Car Insurance

- 15 Common Exclusions in Comprehensive Policies

Looking for the best car insurance in the UAE? You’re in the right spot. The UAE has many car insurance options. This makes comparing them very important to find the right one for you.

Comprehensive car insurance in the UAE does more than just cover third parties. It also protects your car from accidents, fire, theft, and natural disasters. For a fancy car like an Audi Q7 (2021 model), you might pay between AED 3,500 and AED 8,000.

When you compare comprehensive car insurance in the UAE, think about what’s covered, extra features, and customer service. Top insurers include Sukoon Insurance, RAK Insurance, and Watania Takaful Insurance. They might even give you up to 30% off on comprehensive plans.

To choose wisely, check what’s included in the policy, look at extra features, and read what other customers say. Keep in mind, comprehensive insurance usually costs between AED 500 and AED 2,000 a year. This depends on your car and situation.

Understanding Comprehensive Car Insurance in the UAE

Car insurance in the UAE has two main types: comprehensive and third-party. Comprehensive insurance protects your vehicle and you more. It’s important to know the difference between comprehensive and third-party coverage.

Definition and Coverage

Comprehensive car insurance in the UAE covers you and third parties. It helps with damages to your car from accidents, theft, fire, vandalism, and natural disasters. This makes it great for newer or valuable cars.

Legal Requirements in the UAE

While third-party insurance is the minimum needed in the UAE, many choose comprehensive. Banks often ask for comprehensive insurance for car loans. This shows its importance.

Benefits of Comprehensive Coverage

Comprehensive coverage has many benefits over third-party insurance in the UAE. It includes towing services, roadside assistance, and may cover medical costs. It also protects against theft and vandalism, giving car owners peace of mind.

| Feature | Comprehensive | Third-Party |

|---|---|---|

| Own Vehicle Damage | Covered | Not Covered |

| Third-Party Liability | Covered | Covered |

| Theft Protection | Included | Not Included |

| Natural Disaster Coverage | Often Included | Not Included |

Comprehensive Plans Comparison UAE: Key Factors to Consider

When looking at comprehensive car insurance in the UAE, you need to weigh several key factors. This is especially important for expats and luxury vehicle owners seeking the best coverage. Let’s break down what you should focus on during your expat comparison UAE process.

Coverage is a top priority. Comprehensive plans offer protection beyond basic third-party liability. They safeguard your vehicle against theft, fire, and accidental damage. For luxury vehicle comprehensive comparison UAE, it’s crucial to ensure high-value cars get adequate coverage.

Premium costs vary widely. Basic health insurance starts around AED 917 yearly, while comprehensive plans begin at AED 2,409. Car insurance follows a similar pattern, with luxury vehicles typically incurring higher premiums.

The claim process is another vital factor. Look for insurers offering online claim filing and 24/7 customer support. This can make a big difference when you’re in a stressful situation post-accident.

Consider the insurer’s claim settlement ratio. This indicates how reliably they pay out claims. A higher ratio suggests better service and fewer hassles when you need to make a claim.

| Factor | Importance | Considerations |

|---|---|---|

| Coverage | High | Theft, fire, accidental damage |

| Premium Cost | High | Varies by vehicle value and type |

| Claim Process | Medium | Online filing, 24/7 support |

| Settlement Ratio | Medium | Higher ratio preferred |

Remember, comprehensive plans offer more than basic ones. They provide direct access to top hospitals and cover a wide range of services. This can save you from financial strain during emergencies.

Top Insurance Providers for Comprehensive Coverage

Looking for the best SUV comprehensive comparison UAE options? You’ll find top insurance providers. They offer great coverage for your vehicle, including temporary plans.

AXA Insurance

AXA Insurance is a standout with its Motor Prestige and Motor Perfect Plans. These plans fit many vehicle types, including SUVs. AXA’s coverage protects you in many situations, like accidents or natural disasters.

Watania

Watania has flexible comprehensive plans for UAE drivers. They have over 1600 hospitals and clinics in their network. Their plans include extra benefits like roadside help and temporary cars.

Adamjee Insurance

Adamjee Insurance focuses on customers. They have plans that you can customize to meet your needs. Whether you need long-term or temporary coverage, Adamjee has it.

RSA Insurance

RSA Insurance has strong coverage with its Motor Executive and Motor Smart plans. These are great for SUV owners wanting full protection. RSA’s plans often include new car replacement and personal accident coverage.

| Provider | Notable Features | Network Size |

|---|---|---|

| AXA Insurance | Motor Prestige and Perfect Plans | Extensive UAE coverage |

| Watania | Flexible plans, roadside assistance | 1600+ hospitals and clinics |

| Adamjee Insurance | Customizable plans | Wide UAE network |

| RSA Insurance | New car replacement, personal accident coverage | Comprehensive UAE coverage |

Comparing Premium Rates Across Providers

When you’re looking for car insurance in the UAE, it’s key to compare prices. Prices change based on your car, its model, and who drives it. Let’s see how prices differ and how to get the best deal.

In Dubai, only 40% of drivers pick comprehensive car insurance. This means many drivers might not have enough coverage. It’s important to compare rates and what’s covered.

Online tools make it simple to find good rates. YallaCompare and InsuranceMarket.ae are great for comparing car insurance in the UAE. They let you get quotes from top insurers in Dubai quickly, saving you time.

Now, let’s look at some sample premium rates for comprehensive coverage:

| Insurance Provider | Annual Premium (AED) | Third-Party Damage Cover |

|---|---|---|

| GIG Gulf Insurance | 1,500 | Up to 3.5 million |

| Noor Takaful | 819 | Up to 2 million |

| Sukoon Insurance | 1,200 | Up to 2.5 million |

| Al Sagr National Insurance | 1,350 | Up to 2 million |

Keep in mind, these rates are just examples. They can change based on your situation. Use online tools to get quotes that fit your needs.

Coverage Limits and Third-Party Liability

When you look at car insurance in the UAE, knowing about coverage limits and third-party liability is key. A digital tool can help you understand these parts of your policy.

Standard Coverage Limits

Coverage limits differ among UAE insurers. For example, some plans offer up to AED 2 million for third-party property damage. Others go up to AED 5 million. Make sure your renewal comparison focuses on these limits for enough protection.

Options for Increased Liability Protection

In the UAE, many insurers let you boost liability protection. This extra coverage is great for those with expensive cars or lots of assets. When you compare plans, look for ones that let you adjust liability limits to fit your needs.

| Coverage Type | Standard Limit | Enhanced Limit Option |

|---|---|---|

| Third-Party Property Damage | AED 2 million | Up to AED 5 million |

| Personal Accident Cover | AED 200,000 | Up to AED 500,000 |

| Medical Expenses | AED 2,000 | Up to AED 5,000 |

Keep in mind, higher limits mean higher costs. Use a digital tool to find the best mix of coverage and price for your UAE insurance renewal.

Additional Benefits and Add-ons

Comprehensive car insurance in the UAE comes with many add-ons. These extras let you tailor your policy to fit your needs. Let’s look at some popular add-ons that offer extra protection and peace of mind.

When looking at insurance plans for quick claims in the UAE, think about these valuable add-ons:

- Zero Depreciation Cover: Good for cars up to five years old. It covers claims without considering depreciation.

- Personal Accident Cover: Pays a fixed amount for injuries, helping with medical costs.

- Engine Protection: Important in disaster-prone areas. It covers engine damage from natural disasters.

- Agency Repairs: Guarantees repairs at authorized workshops with genuine parts for up to three years.

- Consumables Cover: Covers costs for nuts, bolts, engine oil, and other essentials not usually covered.

- Roadside Assistance: Offers help for emergencies like flat tires or battery issues, essential in the UAE’s harsh climate.

- Return to Invoice: Reimburses the current market value of your vehicle in case of theft or severe damage.

These add-ons greatly improve your accident protection in the UAE. They help lessen financial stress from unexpected events. This makes your insurance more complete and suited to your needs.

| Add-on | Benefit |

|---|---|

| Zero Depreciation | Full claim coverage without depreciation |

| Personal Accident | Fixed payout for injuries |

| Engine Protection | Covers disaster-related engine damage |

| Agency Repairs | Authorized workshop repairs with genuine parts |

| Consumables | Covers essential repair parts |

| Roadside Assistance | Emergency help for breakdowns |

| Return to Invoice | Market value reimbursement for total loss |

Claims Process and Customer Support

When looking at affordable comprehensive comparison UAE, knowing how to file claims is key. Insurance companies in the UAE usually take 15 to 21 working days to check claims. This is true for health and auto insurance claims.

Online Claim Filing Options

Many insurers have online claim filing now. This makes it easier to file claims for family vehicles in UAE. Make sure to include all needed documents, like police reports and photos of damage, to avoid delays.

24/7 Customer Support Availability

Top insurance providers in UAE offer customer support all day, every day. This is great for emergencies or urgent questions about your policy. When comparing insurance, think about the quality and availability of customer service.

Roadside Assistance Services

Many auto insurance plans include roadside assistance. This service can be very helpful in emergencies. When comparing family vehicles in UAE, check if roadside assistance is included and what services it offers.

Remember, there’s usually a 60-day limit to submit claims. Know your policy’s terms to avoid missing deadlines. Understanding the claims process and support helps you get the most from your insurance.

Customization Options for Different Vehicle Types

When looking for the best comprehensive policies in the UAE, think about customization for different cars. Insurance companies offer special solutions for each car type. This way, you can find the right protection for your vehicle.

Luxury car owners need more coverage because their cars are worth more. Cars with special upgrades might cost more to insure. SUVs in Dubai have their own insurance options, designed for their size and needs.

Family cars might need extra features like coverage for personal items and medical costs. Cars with special parts need a ‘Certificate of Modification’ from ESMA for insurance.

- Luxury cars: Higher coverage limits, agency repair as brand new

- SUVs: Off-road cover, comprehensive geographical coverage

- Family vehicles: Personal accident benefits for drivers and passengers

- Modified cars: Additional coverage for specific modifications

| Vehicle Type | Recommended Add-ons | Typical Premium Range (AED) |

|---|---|---|

| Luxury Cars | Agency repair, Personal accident cover | 1,500 – 2,000 |

| SUVs | Off-road cover, Windscreen protection | 1,000 – 1,500 |

| Family Vehicles | Personal effects coverage, Hire car benefit | 800 – 1,200 |

| Modified Cars | Specific modification coverage, Higher third-party liability | 1,200 – 1,800 |

Comprehensive car insurance in the UAE usually costs between AED 500 and AED 2,000 a year. This depends on your car’s type and any special features it has.

Comprehensive vs. Third-Party Insurance: A Detailed Comparison

In the UAE, you have two main car insurance choices: comprehensive and third-party. It’s important to know the differences. This will help you pick the right insurance for you.

Coverage Differences

Comprehensive insurance gives you a lot of protection. It covers damage from accidents, natural disasters, fire, and theft. On the other hand, third-party insurance only covers damage you do to others’ property or injuries to them.

| Coverage | Comprehensive | Third-Party |

|---|---|---|

| Own Vehicle Damage | Yes | No |

| Third-Party Damage | Yes | Yes |

| Natural Disasters | Yes | No |

| Theft Protection | Yes | No |

Cost Implications

Comprehensive insurance is pricier because it covers more. In the UAE, it costs between 1.25% and 3% of your car’s value each year. Third-party insurance is cheaper, making it a good choice for those on a budget or with older cars.

Suitability for Different Scenarios

Comprehensive insurance is best for new or luxury cars in the UAE. It offers a lot of protection. For cars over 7 years old in Dubai, you can only get third-party insurance. Use a car insurance calculator comparison UAE tool to compare your options, especially for luxury vehicles.

Decide based on your car’s value, age, and your budget. While comprehensive is more expensive, it provides better protection. This makes it a popular choice for many UAE drivers.

Digital Tools for Easy Comparison and Purchase

Car insurance shopping in the UAE is now online. Websites let you compare and buy policies easily. This makes finding SUV protection in the UAE quick and simple.

Insurance comparison sites ask for your info once. Then, they show you quotes from many providers. This saves time and helps you find the best deals. Sites like Insurancehub.ae and Yallacompare.com are popular for this.

- Instant quotes from various insurers

- Side-by-side policy comparisons

- Expert advice on choosing coverage

- Secure online purchase options

These tools let you compare different plans. You can look at comprehensive coverage, third-party liability, and extra features. Many sites also offer customer reviews and ratings to help you decide.

Digital tools make it easy to find the right insurance for you. Whether it’s for a family SUV or a luxury car, these platforms make buying insurance in the UAE simple.

Factors Affecting Comprehensive Insurance Premiums

When looking at temporary comprehensive plans in the UAE, it’s key to know what affects insurance costs. Your car’s type, age, how long you’ve been driving, and your claims history all matter a lot.

Vehicle Make and Model

Luxury and sports cars usually cost more to insure. This is because they’re pricier to fix and have a higher risk of accidents. On the other hand, older cars are cheaper to insure but might break down more often, adding to costs.

Driver’s Age and Experience

In the UAE, young drivers pay more for insurance. This is because they’re more likely to get into accidents and have less driving experience. As you get older and more experienced, your insurance costs can go down.

Claims History

Your past claims greatly affect your insurance costs. If you haven’t made any claims, you might get a no-claim bonus. This can lower your future premiums. It’s especially important when looking at repair insurance in the UAE.

| Factor | Impact on Premium |

|---|---|

| Luxury/Sports Car | Higher |

| Older Vehicle | Lower (with exceptions) |

| Young Driver | Higher |

| Experienced Driver | Lower |

| Clean Claims History | Lower |

Your home location also changes your premium. Places with more traffic usually have higher costs because of the increased accident risk. To get the best insurance, compare different plans, think about what you need, and choose wisely.

Special Considerations for Luxury and High-Value Vehicles

Owning a luxury vehicle in the UAE has special insurance needs. You’ll find plans made just for high-end cars. These policies offer more protection and services than usual.

In Dubai, insurance companies look at many things when setting prices for luxury cars. They consider the car’s make and model, your driving history, and where you park. How much you drive and how you use your car also affects your rates.

For SUV protection in the UAE, look for policies with agreed value coverage. This means you get a set amount if your car is totaled, without losing money to depreciation. Many insurers also offer special repair shops and roadside help for luxury vehicles.

| Feature | Benefit |

|---|---|

| Agreed Value Coverage | Predetermined payout for total loss |

| Exclusive Repair Shops | Specialized service for luxury vehicles |

| Tailored Roadside Assistance | Premium support for high-end cars |

| Personal Belongings Coverage | Protection for valuables in your car |

| Legal Expense Coverage | Financial support for legal issues |

Some insurers use telematics to track how you drive. This can lead to lower insurance costs. When comparing, look for policies that cover your personal items and protect against uninsured drivers.

Understanding Policy Terms and Conditions

When you use digital car insurance comparison tools in the UAE, it’s key to understand policy terms and conditions. This knowledge helps you make smart choices about your coverage. It’s especially important for temporary comprehensive plans in the UAE.

First, look at coverage limits. These show the most your insurer will pay for claims. Then, check deductibles – the amount you pay first before insurance helps.

Don’t miss exclusions, which list what your policy doesn’t cover.

Specific clauses in UAE car insurance policies are important. These may include:

- Off-road coverage

- Agency repairs

- Territorial limits (e.g., GCC coverage)

It’s also crucial to know how to file a claim. Find out what documents you’ll need. This helps if you ever need to use your insurance.

Remember, terms can differ between providers. When using digital car insurance comparison tools in the UAE, take time to review each policy’s details. This careful approach ensures you pick a plan that meets your needs. Whether it’s for long-term or temporary comprehensive coverage in the UAE.

Tips for Renewing Comprehensive Car Insurance

Renewing your car insurance in the UAE needs careful planning. Here are some tips to get the best coverage at good rates.

When to Start the Renewal Process

Start your renewal 3-4 weeks before your policy ends. This lets you compare and avoid coverage gaps. UAE insurers offer a 30-day grace period, but it’s safer not to count on it.

Reassessing Coverage Needs

Check if your coverage still fits. For older cars, you might need to change your policy. Compare plans from AXA, Watania, and RSA to find the right one for you.

Negotiating Better Rates

Use online tools to compare rates and options. Look for deals that match your needs. Negotiate with insurers based on your driving record and loyalty. Remember, rates for luxury cars like an Audi Q7 vary from AED 3,500 to AED 8,000.

Think about add-ons like zero depreciation or breakdown help. Always check the claim settlement ratio and customer satisfaction of insurers like Sukoon or GIG Gulf. With these tips, you’ll find the best insurance in the UAE.

Common Exclusions in Comprehensive Policies

When you look at full vehicle protection in the UAE, knowing what’s not covered is key. These exclusions can change how much you pay out of pocket. A car insurance calculator in the UAE can show you these exclusions from different companies.

Wear and tear is often not covered. This means damage from regular use isn’t included. Also, mechanical or electrical failures aren’t covered. Driving under the influence or without a license also means no coverage for damage.

Damage from war or nuclear risks is also not covered. These might seem rare, but it’s good to know. Some policies might not cover certain high-value items or car modifications. When you compare full vehicle protection in the UAE, look closely at these points.

Remember, what’s not covered can differ between companies. Always read the fine print. Use a car insurance calculator in the UAE to find the best policy for you. Knowing what’s excluded can help you avoid surprises and make sure your vehicle is well-protected.