Contents

- 1 Car Insurance Abu Dhabi

- 2 Types of Car Insurance Abu Dhabi

- 3 Third-party Liability (TPL) Car Insurance

- 4 Comprehensive Car Insurance

- 5 Leading Car Insurance Companies in Abu Dhabi

- 6 Required Documents for Car Insurance in Abu Dhabi

- 7 Car Insurance Abu Dhabi Costs

- 8 Top Car Insurance Brokers in Abu Dhabi

- 9 Car Insurance in Abu Dhabi: Al Buhaira Insurance

- 10 Shory: The Premier Car Insurance Provider in Abu Dhabi

- 11 Types of Car Insurance Policies Available in Abu Dhabi

- 12 Steps to Purchase Car Insurance in Abu Dhabi

- 13 Required Documents for Buying Car Insurance in Abu Dhabi

- 14 Car Insurance Abu Dhabi: Compare Quotes and Purchase Online 24/7

- 15 Car Insurance in Abu Dhabi: A Legal Obligation

- 16 10% Discount on Car Insurance in Dubai and the UAE with GIG Gulf

- 17 Your Car Insurance Protection Level by GIG Gulf

- 18 Leading Car Insurance Companies in Abu Dhabi

- 19 Conclusion

Car Insurance Abu Dhabi is an agreement that outlines the responsibilities of an insurance company to assist vehicle owners in the event of an accident. In the UAE, having basic car insurance is compulsory for all vehicle owners, and every driver must possess at least third-party coverage to legally operate a vehicle within the Emirate.

Abu Dhabi adheres to this requirement as well. Securing car insurance in Abu Dhabi is typically one of the first steps after purchasing a vehicle in the capital. This guide aims to provide you with comprehensive information regarding car insurance types, associated costs, and where to find the best coverage in Abu Dhabi.

Car Insurance Abu Dhabi

In Abu Dhabi, car insurance is a crucial obligation for all vehicle owners. It offers financial coverage against unexpected accidents, theft, or damage. With numerous options in the market, selecting the right car insurance policy can be challenging. In this discussion, we will guide you on how to purchase Car Insurance in Abu Dhabi, outline the necessary documents, and highlight the advantages of choosing Al Buhaira Insurance.

Read more: Secure Online Comprehensive Car Insurance in the UAE

Types of Car Insurance Abu Dhabi

Auto insurance providers in Abu Dhabi typically offer two primary types of insurance policies for drivers to choose from based on their needs. Understanding the distinction between comprehensive and third-party car insurance is essential.

- Third-party car insurance.

- Comprehensive car insurance.

Read more: Comprehensive Car Damage Coverage in the UAE

Third-party Liability (TPL) Car Insurance

According to the traffic regulations in Abu Dhabi, every vehicle owner is required to obtain third-party insurance. This type of insurance covers only the damages you cause to another party, leaving the damages to your vehicle uninsured. TPL represents the most basic and affordable car insurance option available in Abu Dhabi, obtainable through local insurance brokers.

Comprehensive Car Insurance

A comprehensive car insurance policy not only includes third-party liability but also covers your vehicle’s repair costs. This policy also protects against losses or damages resulting from theft, fire, self-ignition, or vandalism. While a comprehensive policy is optional, it may be necessary for those whose cars are still under lease until all financial obligations are fulfilled.

Add-on Coverage Options in Comprehensive Car Insurance Policies

To enhance protection, comprehensive car insurance policies can be supplemented with various add-on covers tailored to your needs. Here are some additional benefits you might consider with a premium subscription:

- Theft and Fire: Coverage for losses and damages resulting from theft or fire incidents.

- Windscreen Cover: This covers the replacement and repair costs of a broken or damaged windscreen.

- Off-Road Coverage: Some insurance providers include coverage for unmarked roads.

- Personal Accident Cover: This benefit offers financial compensation for bodily injury to you or a third party involved in an accident.

- Roadside Assistance: This covers mechanical repairs, towing, flat tires, and battery boosts for unexpected breakdowns or fuel shortages.

- Agency Repair: Ideal for luxury vehicles, this service ensures repairs are conducted by authorized professionals following an accident.

- Medical Expenses: Covers medical costs incurred within 24 hours following an accident.

- GCC Coverage: For those traveling by car to nearby countries such as Oman or Saudi Arabia, GCC insurance is required.

Read more: Get the Best Comprehensive Insurance Quotes in the UAE

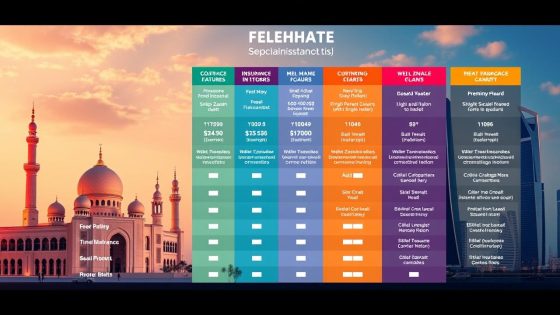

Leading Car Insurance Companies in Abu Dhabi

To ensure you receive the most reliable services, it’s essential to be aware of the top car insurance companies in Abu Dhabi. Here’s a closer look at some of the best options available:

GIG Gulf Insurance

Renowned for its exceptional reputation, GIG Gulf Insurance (formerly known as AXA Car Insurance Abu Dhabi) is our top recommendation for car insurance in Abu Dhabi. The company provides various additional benefits, including 24/7 roadside assistance, coverage for Oman, and more. Additionally, they are currently offering a 10% discount on car insurance premiums in Abu Dhabi. For further information, use the contact details below:

- Location: Plaza30, Building11, Block B –72, Al Meel Street, Nahyan Area, Abu Dhabi.

- Hours: Sunday to Friday: 08:00 am to 05:00 pm | Saturday: Closed.

- Contact: 800-292 or +97145074085.

GIG Gulf Insurance provides three types of policies:

- Motor Prestige

Third-party property damage coverage of AED5 million, personal injury coverage of AED20,000, agency repair coverage for up to5 years, and personal accident benefits.

- Motor Perfect

Third-party property damage coverage of AED3.5 million, personal injury cover of AED20,000, optional agency repairs up to 5 years, and coverage for medical emergencies up to AED3,500, along with AED4,000 for personal asset preservation.

- Motor Third Party

Third-party property damage coverage of AED3.55 million, but without personal injury coverage or agency repairs. This package includes optional driver and passenger protection up to AED200,000 each.

ADNIC Car Insurance

ADNIC Car Insurance provides dependable motor insurance plans suitable for all vehicle types. They also help customers protect their car’s residual value while offering repair and replacement services. The company offers three packages:

- Standard: Basic coverage for third-party liability property damages up to AED2,000,000.

- Gold: More extensive coverage with third-party liability up to AED3,500,000.

- Third-Party Liability: Covers damages up to AED 2,000,000, but does not extend to cover your vehicle or personal injuries.

For additional information about ADNIC’s packages, you can visit or call the following:

- Location: Mohamed Bin Khalifa Street, Al Danah, Zone 1, Abu Dhabi.

- Hours: Monday to Thursday: 08:00 am to05:00 pm | Friday: 08:00 am to 12:00 pm | Saturday and Sunday: Closed.

- Contact: 8008040 | WhatsApp: +97124080900.

Sukoon Insurance Company

Next on the list is Sukoon Insurance, previously known as Oman Car Insurance Abu Dhabi. This company caters to about 830,000 clients and offers insurance products for electric and luxury vehicles. At Sukoon Insurance, motorists can select from various auto insurance plans at competitive rates:

- Third-party car insurance.

- Comprehensive insurance.

- Privilege Motor.

- InsureMyTesla.

For further information and detailed pricing, visit their office or contact them:

- Location: Salam Street, Al Markaziyah, Sheikh Nahyan Bin Khalifa, Building No.126, Abu Dhabi.

- Hours: Monday to Friday: 08:00 am to 05:00 pm | Saturday and Sunday: Closed.

- Contact: +97126128444 | Toll-free number:8004746.

RSA Insurance

RSA is one of the most established and reliable insurance providers in the UAE. They offer both third-party and comprehensive insurance policies, including three classifications: Motor Smart, Motor Executive, and Motor Value.

- Location: Office No.3105,31st Floor, Al Tamouh Tower, Reem Island, Abu Dhabi, UAE.

- Hours: Monday to Friday: 09:00 am to 05:30 pm. Saturday and Sunday: Closed.

- Contact: 800-722-RSA | +97143029800.

Emirates Car Insurance

At Emirates Car Insurance Abu Dhabi, customers can access comprehensive packages and third-party insurance that includes coverage for passengers in the policyholder’s vehicle. The company also provides Motor Fleet Policies, which allow multiple vehicles to be insured under a single policy.

- Location: M26, Near American Veterinary Clinic, Musaffah, Abu Dhabi.

- Hours: Monday to Thursday: 08:00 am to 05:00 pm | Friday: 08:00 am to 12:00 pm | Saturday and Sunday: Closed.

- Contact for car insurance (new or renewal): 80018 | +97126440400.

Al Buhaira National Insurance

With over 43 years of experience in motor insurance, Al Buhaira offers a variety of policies in the UAE. They provide both comprehensive and third-party liability car insurance in Abu Dhabi at competitive rates. For more details about their offerings, visit their website or contact them using the information below:

- Location: Corniche Road, Al Danah, Zone1, Abu Dhabi.

- Hours: Monday to Friday: 08:30 am to 05:00 pm.

- Contact: +97126226200.

Read more: Comprehensive Motorbike Insurance in the UAE

Required Documents for Car Insurance in Abu Dhabi

Here is a list of Documents for Car Insurance in Abu Dhabi:

- A duplicate copy of the police report.

- A copy of the vehicle registration.

- A copy of your driving license.

- Emirates ID card.

- Quotation from the showroom and a Bank Approval Letter for new car insurance.

- For used vehicles, you will need the owner’s previous Registration Card or Possession

- Certificate, photographs of the car, and a passing Certificate from the vehicle inspection.

If you are considering purchasing a used car in Abu Dhabi, ensure you secure insurance before hitting the road. There are numerous used car options available at competitive prices. Here are some popular choices:

- Second-hand Toyota vehicles in Abu Dhabi.

- Used Nissan cars for sale in Abu Dhabi.

- Pre-owned Mercedes Benz vehicles in Abu Dhabi.

- Used BMW cars are available in Abu Dhabi.

Read more: Convenient Comprehensive Insurance Renewal in the UAE

Car Insurance Abu Dhabi Costs

The cost of car insurance in Abu Dhabi is primarily determined by the vehicle’s value, with the average premium being about 2.35% of that amount. Several factors can also affect the insurance cost, including the driver’s age, the number of previous claims, and the type of vehicle being insured. Additionally, it’s essential to understand how to file a car insurance claim in the UAE in the event of an accident. Here are the Considerations for Changing Insurance Providers:

- Compare different insurance offers.

- Select your preferred tariff.

- Ensure timely cancellation of your current policy.

- Pay your insurance premiums punctually.

This summary covers all aspects of car insurance in Abu Dhabi. With insight into the insurance policies, available packages, and top insurance companies in the region, take time to evaluate your needs before committing to a policy.

Read more: Compare Comprehensive Car Insurance Plans in the UAE

Top Car Insurance Brokers in Abu Dhabi

An insurance broker assists clients in locating the most suitable car insurance rates and packages in Abu Dhabi. Based on Google user reviews, here are some of the highest-rated car insurance brokers in the area:

- Liberty Insurance Brokers LLC.

- Al Nahda National Insurance Brokers Company.

- Abu Dhabi Insurance Brokers LLC.

- Howden Guardian Insurance Brokers LLC.

Read more: Best Comprehensive Car Insurance for Expats in the UAE

Car Insurance in Abu Dhabi: Al Buhaira Insurance

Al Buhaira Insurance stands out as one of the top insurance providers in Abu Dhabi. Here are several compelling reasons to consider Al Buhaira Insurance for your car insurance requirements:

Extensive Coverage Options

Al Buhaira Insurance offers a diverse range of coverage options tailored to meet various needs and financial plans.

Seamless Claims Process

In the event of an accident or damage to your vehicle, Al Buhaira Insurance ensures an easy claims process, helping you receive the compensation you are entitled to without unnecessary hassle.

Competitive Pricing

The company provides competitive rates for its car insurance policies, making it an attractive option for customers.

Exceptional Customer Support

Al Buhaira Insurance is renowned for its outstanding customer service, offering continual support to its clients whenever needed.

Read more: Quick and Efficient Comprehensive Car Claims in the UAE

Shory: The Premier Car Insurance Provider in Abu Dhabi

Shory delivers an exceptional experience for acquiring car insurance in Abu Dhabi through the following features:

Fast and Easy Purchase Process

Obtain insurance quotes from multiple providers in real time, compare them, and select the policy that best fits your needs—all in under 90 seconds. This can be done via thier website or mobile app.

Completely Online Experience

The entire process of purchasing insurance is conducted online, eliminating the need to download documents or leave the app, all without any human intervention.

Competitive Pricing and Exclusive Deals

We ensure you receive the best rates for your car insurance by partnering with leading insurance companies.

Tailored Coverage Options

You have the flexibility to add extra coverages and personalize your insurance policy according to your requirements.

Instant Insurance Document Issuance

With Shory, you can receive your insurance document instantly, anytime and anywhere.

Exceptional Customer Support

Our dedicated team is available to provide comprehensive support and guidance throughout your car insurance journey.

Streamlined Claims Management

We offer a straightforward and efficient claims process, ensuring a hassle-free experience whenever you need it.

Read more: Best Comprehensive SUV Insurance in the UAE

Types of Car Insurance Policies Available in Abu Dhabi

Abu Dhabi offers several car insurance policy types, each tailored to different requirements and budgets. Some of the most common policies include:

Third-Party Liability Insurance

This is the minimum legal requirement for car insurance in Abu Dhabi. It covers the policyholder’s liabilities toward third parties in the event of an accident, but it does not cover damages to the policyholder’s vehicle.

Comprehensive Insurance

This is the most all-encompassing car insurance option available in Abu Dhabi. It covers damage to the policyholder’s vehicle and provides liability protection to third parties. Additional features often include personal accident coverage for the policyholder and passengers, roadside assistance, and more.

Agency Repair

This type of policy covers repairs done at authorized dealerships or service centers.

Choosing the right car insurance policy is essential, so consider your individual needs and requirements. It is also advisable to compare offerings and prices from different insurance providers to ensure you are getting the best value and coverage.

Read more: Explore Comprehensive Car Insurance Plans in Dubai

Steps to Purchase Car Insurance in Abu Dhabi

To buy car insurance in Abu Dhabi, follow these steps:

Step 1

Research: Before making a purchase, investigate various insurance providers in Abu Dhabi to compare rates and policy benefits.

Step 2

Select the Right Coverage: Identify the coverage necessary for your vehicle. There are three main types of car insurance in Abu Dhabi: Third-Party Liability Insurance, Third-Party Fire and Theft Insurance, and Comprehensive Insurance.

Step 3

Request a Quote: After deciding on the desired coverage, request a quote from your chosen insurance provider.

Step 4

Submit Documents: Once you receive a quote, provide the necessary documents to the insurance company, and they will issue a policy for you.

Required Documents for Buying Car Insurance in Abu Dhabi

To purchase car insurance in Abu Dhabi, you will need the following documents:

- Emirates ID: A valid Emirates ID is essential for purchasing car insurance in Abu Dhabi.

- Car Registration: You must provide a copy of the car registration document.

- Driver’s License: A copy of your driver’s license is also required.

- No-Claims Certificate: If you have previously held a car insurance policy, a no-claims certificate will be necessary.

- Vehicle Inspection Certificate: A vehicle inspection certificate from an authorized inspection center in Abu Dhabi is required to obtain car insurance.

Car Insurance Abu Dhabi: Compare Quotes and Purchase Online 24/7

Car insurance in Abu Dhabi is crucial for ensuring your safety while navigating the emirate’s beautiful roads. Prioritizing safety, car insurance offers essential protection and peace of mind for you and your loved ones in the event of unforeseen accidents. The car insurance framework in Abu Dhabi includes specific legal requirements that distinguish it from other regions. Join us in this detailed guide to discover everything you need to know about car insurance in Abu Dhabi and how to select the best plan that aligns with your needs and budget.

Car Insurance in Abu Dhabi: A Legal Obligation

In Abu Dhabi, all registered vehicles must have third-party insurance, which covers any material and bodily damage caused to others in an accident for which you are responsible. However, this insurance does not cover damages to your vehicle or injuries you may sustain. The market features a variety of insurance companies that offer numerous packages and additional services to cater to the diverse needs of drivers in Abu Dhabi.

10% Discount on Car Insurance in Dubai and the UAE with GIG Gulf

Car insurance is a mandatory requirement. At GIG Gulf, they offer top-notch car insurance that can simplify your life in the event of an accident. Whether you’re navigating the vibrant streets of Dubai or taking in the stunning scenery of the UAE, every drive can be an adventure filled with risks, regardless of how cautious you are. Ensure that you and your car are always safeguarded with exceptional insurance from GIG Gulf, now with discounts of up to 10%.

At GIG Gulf, they are committed to providing customized car insurance quotes that cater to your specific needs. Obtain the ideal coverage at a competitive price. With over 70 years of experience, award-winning service, and round-the-clock multilingual customer support, you can trust that GIG Gulf has you and your vehicle protected. Here’s what they offer:

Specialized Car Insurance for Dubai

With their origins in Dubai and coverage extending throughout the UAE, they understand the unique driving conditions and regulations of each emirate.

Comprehensive and Third-Party Options

They offer a range of car insurance solutions, from comprehensive coverage to economical third-party insurance, thanks to their three-tier insurance system. You can also enhance your policy with additional features such as GCC coverage.

Transparent Claims Process and 24/7 Assistance

Their team is available to help you both day and night. Whether you are seeking car insurance or need assistance with a claim, they are easily accessible and provide complete online car insurance policies and claims services.

GIG Gulf Comprehensive Car Insurance Plan

Key advantages of their comprehensive car insurance plan include:

- Complimentary airport pick-up and drop-off concierge service valued at AED250.

- Free vehicle service pick-up and drop-off worth AED250.

- No-cost car inspection pick-up and drop-off service for registration renewal.

Your Car Insurance Protection Level by GIG Gulf

From fully comprehensive coverage to affordable basic protection, they offer something for everyone. All our car insurance policies come with 24-hour accident assistance and breakdown recovery, along with no-claims discounts. This means you don’t have to sacrifice important insurance features, even if you’re on a budget. Here are additional fantastic benefits provided by GIG Gulf car insurance across their three levels of coverage:

- Fully Comprehensive Motor Prestige.

- Adaptable Motor Perfect.

- Cost-effective Motor Third Party.

Motor Prestige: For Those Who Demand Excellence

Experience premium car insurance coverage accompanied by a wealth of benefits:

- Complete Vehicle Protection: Safeguard against theft or damage.

- Third-Party Liability Coverage: Up to AED5 million for bodily injury and property damage.

- Thorough Environmental & Criminal Protection: Coverage for fire, theft, storms, floods, riots, and strikes.

- Personal Injury Coverage: Up to AED20,000.

- Emergency Medical Assistance: Up to AED6,000.

- Protection for Personal Belongings: Up to AED4,000.

- Expanded Coverage Options: Including insurance for Oman and off-road driving.

- Guaranteed Agency Repairs: Assurance for up to5 years.

- Total Loss Coverage: Invoice value protected for 24 months from the date of first registration.

- Comprehensive Services & Benefits: Ranging from windscreen damage waivers to 24-hour recovery services, GCC coverage, and convenient vehicle pick-up and drop-off.

Motor Perfect: The Ideal Balance of Coverage and Cost

Their flexible car insurance plan delivers an array of comprehensive benefits:

- Damage Protection for Your Vehicle: Coverage for theft and damage.

- Third-Party Liability: Up to AED3.5 million for bodily injury and property damage.

- Extensive Protection: From natural disasters to theft.

- Personal and Medical Coverage: Up to AED20,000 for injuries and AED3,500 for medical emergencies.

- Protection for Personal Assets: Safeguard belongings up to AED4,000.

- Freedom to Roam: Coverage includes Oman and off-road insurance.

- Flexible Repair Choices: Option for agency repairs for up to 5 years.

- Custom Benefits: Including total loss protection and optional hire car benefits along with pick-up and drop-off services.

Read more: Comprehensive Motorbike Insurance in the UAE

Leading Car Insurance Companies in Abu Dhabi

Here are some of the most popular car insurance providers in Abu Dhabi:

AXA Car Insurance

AXA is recognized as one of the premier car insurance brands, offering exceptional insurance plans for vehicle owners across the UAE. It holds the distinction of being ranked No.1 among global insurance brands and is particularly favored by car owners.

ADAMJEE Insurance Company in the UAE

ADAMJEE Insurance is regarded as one of the most reliable insurance providers in the GCC, consistently ranking among the top three. It enjoys a strong reputation in the UAE and provides a wide array of car insurance options.

NOOR Takaful Insurance Provider

Known for its prompt and efficient claims handling, Noor Takaful operates by Islamic Sharia laws. The company offers an attractive range of insurance features, add-ons, and customizable plans tailored to car owners.

AMAN Insurance Company

AMAN is another highly regarded insurance provider in the UAE, offering various plans for car, marine, and fire insurance. It provides coverage for both third-party liabilities and comprehensive plans, along with several additional options and affordable premiums.

UNION Insurance Company

Founded in 1998, UNION Insurance Company has established a strong corporate presence and quickly expanded its services throughout the UAE. The company is noted for its competitive, flexible, and cost-effective insurance plans.

Conclusion

Car Insurance Abu Dhabi is a crucial tool for drivers to protect their vehicles and finances. With various types of car insurance available, including comprehensive and third-party options, it’s essential to assess your individual needs. Companies like Al Buhaira Insurance and Shory Insurance offer competitive policies that cater to both new and experienced drivers. For those seeking the best comprehensive motor insurance coverage, the Abu Dhabi National Insurance Company is a notable provider.

Additionally, exploring options for comprehensive cheapest car insurance can lead to significant savings without compromising on quality. Ultimately, choosing the right car insurance provider in Abu Dhabi not only provides peace of mind but also ensures you are adequately covered on the roads of the UAE. Take the time to compare policies and decide on your vehicle’s protection.

Who is known for the cheapest car insurance?

Fully comprehensive insurance is typically the least expensive, however rates vary depending on individual circumstances.

Which insurance network is best in the UAE?

List of Best Health Insurance Network Companies in the UAE:

– Takaful Emarat.

– Orient Takaful.

– Orient Insurance.

– Cigna insurance.

– ADNIC.

– Salama Insurance.

– Watani Takaful Insurance.

– Daman Insurance.

What is the best car insurance in the UAE?

The Comprehensive Car Insurance Policy is the best type of insurance policy that provides complete protection. It covers both third-party liabilities as well as damages to your vehicle. Also, with a comprehensive cover, you can get compensation if the accident results in your death; the family members will receive the benefit.

How much is car insurance in Abu Dhabi?

The average premium rate in Abu Dhabi is 2.35% of the car’s value. Other factors that influence the price of auto insurance in Abu Dhabi include the driver’s age, the number of previous insurance claims, the type of car you intend to purchase, and others.