What if we told you a coastal settlement with fewer than 300 residents in 1950 now thrives as a hub for over 400,000 people? This isn’t Dubai’s origin story—it’s the lesser-known journey of an emirate hugging the Arabian Gulf coastline at 25°24′49″N 55°26′44″E. Once defined by pearl diving and fishing boats, its evolution mirrors the UAE’s meteoric rise.

Founded by the Al Nuaim tribe in the 18th century, this area grew through maritime trade and strategic alliances. By 1971, it became a founding member of the United Arab Emirates, trading wooden dhows for skyscrapers while preserving its cultural roots. The ruler’s 1820 maritime treaty with Britain marked early steps toward global connections—a tradition continuing today through hubs like the Ajman Free Zone supporting 1,500 businesses.

Three elements define its transformation:

- Location as legacy: The sheltered coast nurtured trade routes now vital to modern shipping

- Cultural continuity: Ancient forts stand alongside innovation centers

- Balanced growth: Population surged 1,700% since 1950 without losing community roots

From tidal flats to economic tides, this emirate’s story reveals how tradition fuels progress across the UAE.

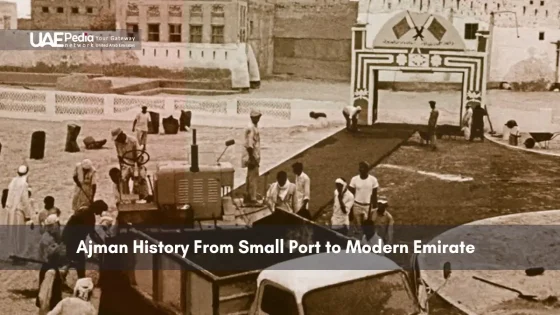

Early Foundations: From Humble Beginnings to a Coastal Settlement

Imagine a sun-baked shoreline where wooden dhows bobbed in turquoise waters—this was the birthplace of a community that would anchor an emirate. Long before skylines and highways, the Al Nuaim tribe carved their legacy into this stretch of the Arabian Gulf around 1775. Their settlement thrived not through grandeur, but through grit and saltwater wisdom.

Origins with the Al Nuaim Tribe

The tribe’s arrival transformed the coast into a living map of resilience. They built palm-frond homes near tidal creeks, where fishing nets dried like lacework under the sun. Every morning, divers plunged into pearl beds while farmers coaxed dates from arid soil—a rhythm that sustained the city’s earliest heartbeat.

Traditional Livelihoods: Fishing, Pearl Diving, and Farming

You’d smell smoked fish before seeing the village. Boats returned with silvery catches as children raced to greet fathers bearing oysters—nature’s lottery tickets. This wasn’t just survival; it was a masterclass in thriving with what the land and sea offered.

The area’s strategic position made it a quiet player in the UAE’s maritime trade history. Monsoon winds carried traders to its shores, exchanging stories alongside dried lemons and pearls. Even then, visitors found warmth in shared coffee pots—a hospitality tradition older than any modern hotel.

What’s extraordinary? How these threads—fishing nets, pearl divers’ songs, date palm shadows—wove the fabric of a region now vital to the United Arab Emirates. Walk Ajman’s corniche today, and you’re tracing footsteps laid centuries ago by a tribe who understood the art of turning tides into tomorrows.

ajman history: Transformation and Treaty Milestones

Picture this: a ruler’s seal pressed into wax, binding a small coastal tribe to global superpowers. That moment in 1820—when Ajman’s leadership signed the General Maritime Treaty with Britain—turned fishing villages into geopolitical players. The agreement wasn’t just about safe seas; it reshaped the region’s DNA.

When Dhows Met Diplomacy

British ships arrived seeking stability along trade routes, but found more than compliant partners. Early surveys show Ajman’s population swung between 750 (winter) and 1,200 (summer) in the 19th century—proof of seasonal fishing migrations. The coast wasn’t just a food source; it became a bargaining chip.

“These shores hold more pearls than oysters—they’re gateways.”

Three shifts defined this era:

| Year | Event | Impact |

|---|---|---|

| 1820 | General Maritime Treaty | British protection in exchange for naval access |

| 1892 | Exclusive Agreement | Formalized foreign policy oversight |

| 1952 | Trucial States Council | Collaborative governance with neighbors like Umm Quwain |

While hotels and modern ports came later, the groundwork was laid here. Tribal leaders—once focused on date harvests—now negotiated with naval officers. Yet through it all, the ruler kept one foot in tradition, ensuring the Trucial States’ legacy remained rooted in local values.

Today’s skyline? Just the latest chapter. Those treaty signatures still echo through boardrooms and fishing harbors alike—proof that ink can shape destiny as deeply as tides.

Cultural Heritage and Modern Economic Growth in Ajman

Breathe in cardamom-scented air near spice stalls, then glance up at glass towers—this is where tradition shakes hands with tomorrow. The emirate thrives by weaving its past into every modern thread, creating a tapestry that enchants both locals and visitors.

Preserving Tradition: Local Cuisine and Attire

You’ll taste history in steaming platters of machboos—saffron rice layered with tender lamb. Women’s abayas flutter like ink strokes against sunlit souks, while men’s crisp kanduras mirror the desert’s simplicity. At the Ajman Museum, housed in an 18th-century fort, artifacts whisper tales of pearl divers and palm-frond homes.

Urbanization, Commercial Markets, and Tourism Developments

The city’s heartbeat quickens in its markets. Haggle for gold at the century-old souk, then stroll a mall where robot baristas brew karak chai. Luxury hotels rise beside fishing docks, offering sunset dhow cruises between skyscraper views.

| Traditional | Modern | Where to Experience |

|---|---|---|

| Handwoven sadu textiles | Designer boutiques | Ajman China Mall |

| Fresh fish auctions | Gourmet seafood towers | Al Zorah Marina |

| Folk dance performances | VR heritage tours | Ajman Museum courtyard |

This area proves progress needs no bulldozers. Night markets glow with neon and lanterns alike—proof that the United Arab Emirates’ soul thrives when old and new share the same plate.

Reflection on Ajman’s Legacy and Future Prospects

Stand at the crossroads of a desert breeze and a digital future—this emirate thrives by turning yesterday’s wisdom into tomorrow’s blueprint. Over the past century, fishing nets have given way to fiber-optic cables, yet the rhythm of dhow sails still syncs with construction cranes.

Wander through the Ajman Museum, where pearl divers’ tools share space with VR exhibits. The city’s population boom—from humble beginnings to half a million residents—fuels new hotels and waterfront promenades. Yet date palms still shade traditional markets where haggling feels like poetry.

Three threads weave Ajman’s story forward:

- Cultural bridges: Shared traditions with neighbors like Umm Quwain strengthen regional identity

- Urban alchemy: Shopping malls glow beside heritage sites, blending commerce with culture

- Time travelers: Young entrepreneurs code apps in cafes steps from 200-year-old forts

Tomorrow’s skyline will rise higher, but the soul of this area remains grounded in saltwater and sand. As you explore Ajman City today, remember—every modern tower casts a shadow shaped by centuries of resilience.

The Al Nuaim tribe, led by Sheikh Rashid bin Humaid Al Nuaimi in 1750, transformed the area from a quiet fishing village into a strategic coastal settlement. Their leadership shaped the emirate’s identity long before the UAE’s formation.

Life revolved around the sea and desert. Families relied on pearl diving, fishing, and date farming. You’ll still see dhows (traditional boats) along the creek, echoing this maritime heritage.

The 1820 Maritime Truce with Britain aimed to protect trade routes, ending pirate raids. While Ajman kept its autonomy, this pact laid groundwork for the eventual unity of the seven emirates in 1971.

Think souqs buzzing beside glass towers! Museums like Ajman Fort showcase Bedouin artifacts, while Friday markets sell oud and handmade pottery. Even new malls often feature Arabic architectural motifs.

Don’t miss the 18th-century Ajman Museum in a restored fort, the Al Murabba Watchtower, and dhow-building yards. For culture, time your trip with the Camel Festival or Date Market harvest season.