What if we told you Dubai’s glittering skyline was built on a foundation of pearl diving and desert diplomacy? Long before skyscrapers, this emirate thrived as a trading post along the Persian Gulf, where merchants haggled over spices and pearls under the watch of strategic forts. By 1799, records already hinted at its potential—a humble creek-side settlement with big dreams.

Dubai’s story isn’t just about oil or ambition. It’s shaped by geography: the natural harbor of Dubai Creek became a lifeline, connecting Bedouin tribes to global traders. When Britain signed a maritime truce here in 1820, it marked the start of the United Arab Emirates’ journey toward unity. Tribal leaders, like the Al Maktoum family, turned this city into a beacon of stability—a rarity in the region.

By the early 1900s, the population hovered around 20,000. But even then, Dubai pulsed with diversity: Iranians, Indians, and Arabs bartered goods, laying the groundwork for today’s multicultural hub. The government’s knack for balancing tradition with innovation? That’s a centuries-old skill.

Key takeaways:

- Dubai Creek and the Persian Gulf anchored early trade, fueling the city’s rise.

- Strategic treaties and tribal leadership forged its identity within the Arab Emirates.

- Long before oil, pearl diving and cross-cultural exchange defined its history.

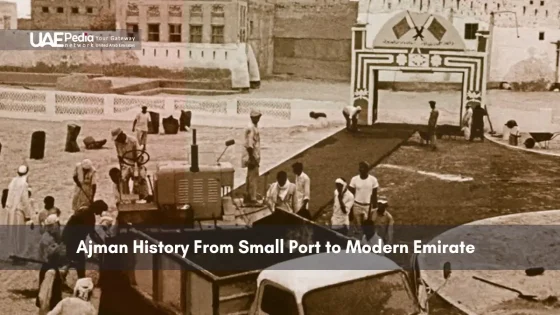

Ancient Roots and Early Settlements

Imagine wandering Dubai’s dunes 9,000 years ago—not a skyscraper in sight, just whispers of ancient campfires under starry skies. Recent digs reveal stone tools and pottery shards dating back to 7000 BCE, proof that this area wasn’t always a desert mirage. Early inhabitants thrived where sand meets sea, adapting to the Persian Gulf’s shifting coastline like nature’s own puzzle.

Archaeological Discoveries and Neolithic Evidence

Dig sites near Jebel Ali show how clever these communities were. They built circular huts from palm fronds and traded obsidian from miles away. Archaeologists found grinding stones stained with date residue—early proof of agriculture in a land where water was gold. “These finds rewrite our understanding of survival in arid zones,” notes a UAE excavation report.

The Role of Nomadic Cattle Herders

Nomadic herders moved cattle between seasonal grazing spots, their routes marked by ancient fire pits. They didn’t just survive—they connected. Caravan stations discovered near Hatta suggest trade networks stretching into Oman. Check out how their tools compare to later innovations:

| Neolithic Tool | Material | Use |

|---|---|---|

| Flint Scrapers | Chert | Hide preparation |

| Grinding Stones | Sandstone | Food processing |

| Shell Fishhooks | Mother-of-pearl | Coastal fishing |

These pioneers laid the groundwork for what became a crossroads of civilizations. Their knack for using every resource—from date palms to tidal pools—shaped the city’s DNA long before oil or pearls. Today’s Dubai still mirrors that spirit: making the impossible look easy in one of Earth’s toughest playgrounds.

Pearls, Maritime Trade, and Early Commerce

Picture this: rough hands sorting moonlit treasures on wooden dhows, salt-crusted divers surfacing with oysters clinging to their ropes. For centuries, Dubai’s heartbeat pulsed not in boardrooms but in the pearl-laden waters of the Persian Gulf. By the 1930s, nearly a third of the city’s population—over 30,000 people—depended on this shimmering industry. “Each pearl held a month’s wages,” recalls an old trader’s diary. That’s how dreams were measured here.

Pearl Diving Heritage and Economic Beginnings

Divers plunged 40 feet on single breaths, their lifelines tied to the boat. From April to September, fleets vanished into the Gulf’s warm currents. The best pearls—called “Gulf drops”—fetched prices rivaling diamonds in Paris markets. This wasn’t just work; it was survival. Families stored rice sacks in coastal homes, waiting for the fleet’s return.

Dubai Creek: Gateway to Regional and Global Trade

While pearls built fortunes, the Dubai Creek carved pathways. Indian merchants sailed here with spices, swapping them for pearls and dates. By 1900, the Creek hosted over 300 dhows annually. Maritime routes stretched from Zanzibar to Mumbai, making this port a crossroads of flavors and fabrics.

Fishing villages bloomed into trading posts. Sheikh Saeed Maktoum’s tax-free policies lured entrepreneurs. Soon, Persian carpets met Chinese silks along the Creek’s banks. Even after pearls lost their luster to cultured alternatives in the 1930s, that hustle never faded. Today’s glittering business towers? They’re just the newest pearls in Dubai’s crown.

Historical Background of Dubai: Tribal Rule and Colonial Influence

Ever wonder how a desert settlement became a global player? The answer lies in 1833—the year the Al Maktoum family seized control. Led by Sheikh Maktoum bin Butti, they turned Dubai Creek into a magnet for regional trade, outmaneuvering rival tribes through savvy alliances. Their secret? Balancing Bedouin traditions with open-door policies for foreign merchants.

From Sandstorms to Statecraft

While tribal skirmishes rocked the Persian Gulf, Dubai’s rulers played chess, not war. They offered tax breaks to Iranian pearl traders and protected British ships—a move that caught London’s eye. By 1820, the General Treaty had stamped out piracy, but Dubai kept its autonomy. “We preferred ink to blood,” an elder once remarked about their treaty negotiations.

British Backing and the Birth of Trucial States

The 1853 Perpetual Maritime Truce transformed the coast. Britain promised protection; local sheikhs kept control. This pact birthed the Trucial States—seven territories united by treaty, not tribe. Dubai thrived as the region’s free-trade rebel, luring entrepreneurs while neighbors clung to old ways.

These deals did more than prevent wars. They wired Dubai for modern government—think courts, ports, and diplomatic ties. When oil arrived decades later, the groundwork was set. Those 19th-century handshakes? They’re why today’s skyscrapers stand in a United Arab Emirates, not scattered desert kingdoms.

Oil Discovery, Industrial Growth, and Urban Transformation

Imagine trading pearls for oil rigs—that’s Dubai’s 1966 plot twist. When black gold gushed from Fateh Field, the emirate swapped dhows for derricks. But here’s the kicker: oil revenues didn’t just fill coffers. They funded a blueprint to reinvent the city as a global player. “We’ll build roads first, then dreams,” declared Sheikh Rashid bin Saeed Al Maktoum, sparking the most audacious makeover in modern history.

Impact of Oil Discovery on Economic Expansion

Oil money flowed like water through the United Arab Emirates. Dubai plowed its share into mega-projects while keeping taxes low. By 1972, Port Rashid opened—a deepwater marvel handling 1.5 million tons annually. Jebel Ali Free Zone followed, luring 7,000 companies with 100% foreign ownership. The economy grew 300% faster than the global average through the 1970s.

Infrastructure Milestones: Ports, Skyscrapers, and Free Zones

Sheikh Rashid’s playbook was simple: build it, and they’ll come. The Creek got dredged, tripling trade capacity. Towers sprouted like desert flowers—first the 39-story Sheikh Rashid Tower in 1979, then the Burj Khalifa, the world’s tallest at 2,717 feet. Free zones turned sand into Silicon Valley rivals, hosting 30% of the country’s GDP by 2020.

Evolution from a Trading Port to a Global Business Hub

Dubai’s secret? Reinvest oil wealth into industry diversity. Today, oil accounts for under 1% of its economy. Instead, you’ve got AI-run metros, robot cops, and the busiest airport for international travelers. Those early merchants bartering spices would’ve never guessed their port would birth a city where 90% of residents are expats building tomorrow.

Reflections on Dubai’s Rich Past and Future Horizons

Think of Dubai as a masterclass in reinvention—a desert port that turned tides into skylines. From pearl divers’ calloused hands to AI-powered metros, this city thrives by honoring its history while racing toward tomorrow. The Al Maktoum family’s vision—crafted in creek-side trade talks—now fuels solar farms and Mars simulations. But how does a place built on oil prepare for a post-carbon world?

Smart government moves hold clues. Lessons from the pearl crash taught Dubai to diversify early. Today, tourism and tech drive 95% of its economy. The United Arab Emirates bets big on green hydrogen and 3D-printed neighborhoods—proof that sand can spark revolutions.

Challenges? Sure. Balancing Bedouin heritage with neon-lit growth isn’t easy. Yet walk through Al Fahidi’s wind towers or Deira’s spice souks, and you’ll see history breathing beside driverless trains. It’s this dance—old dhows docked near robotic ports—that makes the city magnetic.

Dubai’s secret sauce? Its people. Expats and Emiratis together code apps, design vertical forests, and debate AI ethics over karak chai. As the Middle East’s testing ground for tomorrow, this business hub reminds us: the future isn’t built—it’s rewritten daily, with one foot firmly in the sands of time.

Dubai’s rise began with pearl diving and trade along Dubai Creek, then accelerated after oil discovery in 1966. Investments by Sheikh Rashid bin Saeed Al Maktoum in ports, airports, and free zones transformed it into a business hub. Today, tourism, tech, and finance drive its economy alongside iconic projects like Burj Khalifa.

Pearl diving was Dubai’s lifeline before oil! For centuries, dhows sailed from Dubai Creek to harvest pearls traded across the Persian Gulf. This maritime heritage shaped the city’s merchant culture and laid the groundwork for its future as a global trading center.

The Al Maktoum dynasty took power in 1833 when Sheikh Maktoum bin Butti established Dubai as an independent sheikhdom. Their leadership navigated tribal alliances, British treaties, and eventually the formation of the UAE in 1971, steering Dubai toward prosperity.

Oil revenues in the late 1960s funded infrastructure like Port Rashid and Dubai World Trade Centre. But unlike neighboring emirates, Dubai diversified early—focusing on trade, tourism, and aviation—to ensure growth even after its oil reserves declined.

Dubai Creek was the heartbeat of early commerce! Its natural harbor allowed dhows to transport pearls, spices, and gold. Dredging in the 1950s deepened the waterway, cementing Dubai as a key port linking the Middle East, India, and East Africa.

The Trucial States were seven sheikhdoms (including Dubai) under British protection from 1820 until 1971. After Britain’s withdrawal, these states united to form the UAE—a federation blending Bedouin traditions with modern governance.

Nope! Oil now makes up less than 1% of Dubai’s GDP. The emirate thrives on tourism, real estate, aviation (thanks to Emirates Airlines), and tech innovation. Free zones like Dubai Internet City attract global startups, keeping its economy dynamic.

Soaring 828 meters, Burj Khalifa isn’t just the world’s tallest building—it’s a statement. Completed in 2010, it reflects Dubai’s audacity to dream big, blending cutting-edge engineering with a vision to become a global icon of innovation and luxury.