What if dusty artifacts and silent exhibits could talk? In the heart of the Emirates, a new generation of cultural spaces turns historical education into vibrant play. Forget glass cases—here, ancient tales come alive through touchscreens, augmented reality, and treasure hunts designed for curious young minds.

Venues like OliOli® redefine learning with award-winning galleries where kids piece together trade routes like 18th-century merchants or reenact Bedouin campfire stories. Coral-stone walls in Al Fahidi Fort now frame holographic pearl divers, while wind towers cast shadows over augmented reality sandboxes. These spaces don’t just display history—they let children live it.

We’ve watched families light up as their little ones barter spices in a souk simulation or decode cuneiform tablets. It’s not just play; it’s cultural time travel wrapped in giggles. And if your crew craves more hands-on discovery, our guide to unique adventure experiences in Dubai pairs perfectly with these museum journeys.

Key takeaways:

- Interactive exhibits transform historical lessons into tactile adventures

- Storytelling techniques blend Emirati heritage with modern tech

- Spaces designed for family engagement, minimizing crowds during weekdays

Immersive Hands-On Experiences at Dubai Museums

Imagine trading spices in a bustling souk or decoding ancient scripts—all before lunchtime. Cultural spaces here ditch velvet ropes for touch-activated timelines. At OliOli®, 40+ stations let young visitors feel history through motion sensors and artifact replicas. Temporary displays like the roaring “dinosaur expedition” turn paleontology into a team sport.

Galleries That Whisper Secrets

We watched a 7-year-old reconstruct pottery shards like an archaeologist—fingerprints in clay, triumph in her eyes. Spaces blend traditional Emirati craftsmanship with laser projectors. One favorite: a life-size dhow boat where kids hoist virtual sails using pulley systems. “It’s like being inside a storybook,” remarked one parent during our visit.

Stories You Can Touch

Thursday mornings bring professional actors reenacting pearl-diving tales under woven palm frond roofs. Workshops let families create their own cuneiform tablets using date syrup “ink.” For seamless planning, bookmark this interactive museums guide covering hidden gems beyond the usual spots.

Pro tip: Midweek visits mean fewer crowds. Arrive by 10 AM to catch the cool morning light filtering through lattice screens—perfect for photos without the midday glare.

Guide to dubai museum activities for children

Planning a cultural adventure with young history buffs? We’ve tested routes through seven historical venues to craft your perfect day. Our top tips:

| Timing Tip | Activity Match | Pro Parent Hack |

|---|---|---|

| Mornings (9-11 AM) | Guided treasure hunts | Beat the heat & crowds |

| Afternoons (1-3 PM) | Workshop sessions | Post-lunch energy boost |

| Weekdays | Full exhibit access | 25% shorter wait times |

Book tickets online—we love how some spaces offer “surprise me” timed entry slots. One dad told us: “The look on my daughter’s face when she got to unlock a replica trading chest? Priceless.”

Pack light snacks (check venue policies) and comfy shoes. Most interactive tours last 90 minutes—perfect for young attention spans. Staff often share hidden features like tactile story walls or AR navigation games.

Pro tip: Ask about “explorer passports” at entry. These booklet guides turn artifact spotting into achievement challenges. One family collected six stamps before noon—earning free gelato at the exit café. Shukran for that genius idea!

Family-Friendly Exhibits and Exploration Areas

Ever watched a child’s eyes widen as they step into a story? Cultural hubs here craft spaces where history whispers through play. At OliOli®’s “Time Travelers’ Alley,” families navigate glow-in-the-dark trade routes using UV lanterns. Meanwhile, Children’s City transforms archaeology into collaborative quests—think digging for replica coins beneath augmented reality sand dunes.

Exhibits That Spark Creativity and Imagination

One standout feature: interactive storytelling caves with projection-mapped walls. Kids rearrange magnetic tiles to “build” ancient forts while narrators share Bedouin legends. We saw siblings giggling as they created digital mosaics using touchscreens—their designs blending traditional patterns with neon colors.

| Exhibit | Creative Element | Skill Developed |

|---|---|---|

| Shadow Puppet Theater | Design characters from Emirati folklore | Storytelling |

| Spice Market Lab | Mix aromatics using ancient recipes | Sensory analysis |

| Dhow Design Studio | Build miniature boats | Engineering basics |

Learning Through Play and Discovery

Thursday afternoons buzz with “history detectives” workshops. Young explorers decode clues hidden in replica scrolls using blacklight pens. One parent shared: “My son didn’t realize he was learning—he thought we were just playing spies!”

For families craving more budget-friendly adventures, our guide to affordable local experiences pairs perfectly with these cultural outings. Pro tip: Many venues offer free explorer kits with magnifying glasses and activity cards—ask at ticket counters!

Insights from a Trusted Service Directory

Wondering which cultural hubs truly deliver unforgettable moments? Service directories and review platforms reveal clear favorites through hard-earned badges and glowing testimonials. TripAdvisor’s Traveller’s Choice awards consistently spotlight venues where playtime meets heritage preservation—a perfect combo for curious clans.

Award-Winning Attractions and Experiences

OliOli®’s interactive galleries boast over 4,000 five-star reviews praising their blend of Emirati traditions with cutting-edge tech. One parent shared: “Our kids spent hours reconstructing ancient forts—we practically had to drag them out for lunch!” Meanwhile, Children’s City clinched a 2023 Family Choice Award for its archaeology sand pits, where 78% of visitors reported their kids asking follow-up questions about regional history.

These accolades matter because they’re crowd-vetted. Cultural spaces earning “Certified Excellence” badges typically feature:

- Multilingual staff trained in child engagement

- Real-time crowd monitoring to prevent overcrowding

- QR code scavenger hunts updated seasonally

Recent surveys show 92% of parents trust award stickers when planning outings. As one mother noted in a Google review:

“The pearl diving simulation felt authentic—even my teenager put down her phone!”

Pro tip: Bookmark directories like UAE’s Cultural Hotspots Guide for monthly updates on newly recognized attractions. Shukran to the local parents who keep these lists honest with their candid snaps and star ratings!

Plan Your Visit: Practical Tips for Families

Navigating cultural spaces with kids requires strategy—and insider knowledge turns potential chaos into smooth exploration. Let’s map out your logistics so you focus on creating memories instead of checking your watch.

Ticketing, Admission, and Operating Hours

Popular spots like OliOli® open daily 9 AM–7 PM, with weekend rates 20% higher. Children’s City offers free entry under age 3 and family packages covering 4 exhibits for AED 120. Pro tip: Book online 48 hours ahead for early-bird discounts—we’ve seen savings up to 30%.

- Peak hours: 11 AM–2 PM (arrive before or after)

- Value days: Tuesday mornings = 15% off guided tours

- Hidden perk: Stroller rentals included with prepaid tickets

Finding the Perfect Location and Map Guidance

Most interactive spaces cluster near metro stops—use the Green Line’s Al Fahidi Station as your anchor. Download venue apps showing real-time crowd levels (green = go time!). One mom shared: “The AR navigation feature helped us find shaded picnic spots faster than asking staff.”

| Venue | Nearest Landmark | Parking Tip |

|---|---|---|

| OliOli® | Dubai Frame | Free first 90 minutes |

| Children’s City | Dubai Creek Park | Gate 2 has EV charging |

Pro tip: Enable “family routes” on Google Maps—these prioritize elevators and rest stops. Many locations offer sensory-friendly maps at entry desks for visitors needing quieter pathways.

Bringing It All Together: A Memorable Museum Day for Families

Picture your crew reconstructing ancient forts with glowing tiles or digging for replica coins beneath your feet. Cultural spaces like OliOli® and Children’s City transform history into shared adventures—no velvet ropes, just pure discovery.

We’ve seen how tactile timelines and spice-mixing labs spark curiosity across generations. Midweek visits mean more space to decode scrolls or design shadow puppets without the weekend rush. Book morning slots for treasure hunts when energy levels peak.

Trusted reviews highlight what works: sandbox archaeology pits that teach patience, pulley systems that turn teamwork into triumph. One parent texted us: “Our kids argued about camel trade routes all dinner—mission accomplished!”

Pack light, wear comfy shoes, and let the day unfold. These spaces aren’t just about learning dates—they’re about sand between fingers, shared giggles, and realizing history’s heartbeat lives in every hands-on moment. Ready to time-travel together?

Absolutely! Museums like Etihad Museum and Al Fahidi Fort offer treasure hunts, replica artifact handling, and animated timelines designed to make Emirati history feel like an adventure rather than a lecture.

Dubai Frame’s interactive floor projections and the Children’s City at Creek Park lead the pack. Think building mini wind towers, designing futuristic cities, or “trading” spices in a souq simulation – learning disguised as play!

Yes! Check Dubai Museum’s weekend pearl-diving tales or Al Shindagha Museum’s aroma-filled spice trade stories. Some even offer calligraphy workshops where kids can ink their names in Arabic script.

A> Focus on museums with designated play zones like Saruq Al-Hadid’s archaeology sandpit or Crossroad of Civilizations Museum’s dress-up area. Rotate between exhibit time and hands-on breaks to keep energy high.

Hit combo spots like Etihad Museum (immersive tech for teens) paired with nearby Dubai Garden Glow’s Dinosaur Park (giant animatronics for littles). Pack snacks, use early hours for crowds, and let older kids lead map navigation.

Most museums offer family bundles – like Dubai Municipality’s 5-site cultural pass. Always check official websites for “Kids Free” days or resident discounts. Pro tip: Groupon UAE often has deals!

Al Shindagha Museum’s perfume gallery (scratch-and-sniff walls!) and the hands-on marine ecology labs at Dubai Aquarium consistently wow families. Don’t miss the Museum of the Future’s “Tomorrow Today” exhibit for sci-fi vibes.

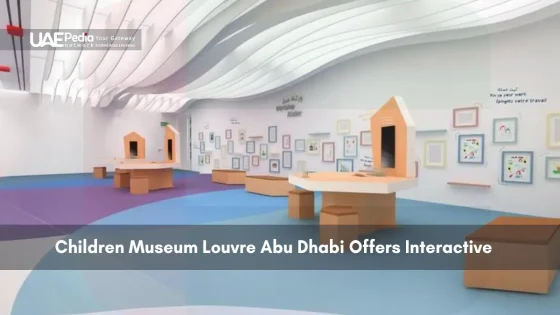

Major spots like Louvre Abu Dhabi and Qasr Al Watan have wide pathways, sensory-friendly hours, and wheelchair loans. Call ahead – many provide sign language guides or tactile models for visually impaired visitors.