What if learning about galaxies felt less like a textbook chapter and more like stepping into a spaceship? At one vibrant cultural destination, young minds don’t just observe exhibits—they become astronauts charting celestial wonders. This isn’t sci-fi; it’s the reimagined interactive art experience now captivating families in the UAE.

The recently refreshed space spans three levels designed as cosmic playgrounds. Think gravity-defying light projections, touchscreens mapping constellations, and puzzle walls revealing scientific secrets. Every corner merges creative expression with physics principles—like painting with magnetic stardust or composing music from planetary orbits.

Backed by the Department of Culture and Tourism, this attraction proves education thrives when curiosity leads the way. Families bond over collaborative challenges, while kids aged 4-10 absorb STEM concepts through sheer delight. Best part? Admission stays wallet-friendly for explorers under 18.

Quick Glimpse:

- Three-story exhibition transforming astronomy into hands-on adventures

- Digital & tactile stations merging art with real scientific phenomena

- Free entry for teens—ideal for budget-conscious itinerary planning

Discover Interactive Exhibits and Immersive Adventures

Ever wondered what happens when Van Gogh’s Starry Night collides with NASA-grade astronomy? The answer unfolds across three floors of tactile wonder, where constellations become paintbrushes and gravity dances to your fingertips. This isn’t passive viewing—it’s a cosmic playground redefining how we experience art and physics.

Unveiling ‘Picturing the Cosmos’—An Interstellar Journey

Step into a realm where swirling galaxies materialize through motion-tracking projections. One visitor described it as “walking through a living storybook—you’re both author and protagonist.” Each floor unveils fresh surprises: sculpt magnetic stardust into 3D planets on Level 1, then race light particles across digital star maps on Level 2. The finale? A collaborative soundscape where planetary orbits compose melodies.

Exploring Multi-Level Exhibitions and Hands-On Activities

Groundbreaking design meets Emirati ingenuity here. Local artists collaborated with astrophysicists to craft stations that feel like play but teach like professors. On the top floor, families solve kinetic puzzles that reveal hidden patterns in classic artworks. “It’s sneaky learning,” laughs a frequent guest. “Kids think they’re just having fun with glow-in-the-dark blocks.”

What truly shines is how every corner adapts to curiosity levels. Tweens dissect light spectra through prismatic lenses, while littles ones chase projected comet tails. As one designer notes: “We built this for the child who asks ‘why?’ 47 times daily—and the adult secretly wondering too.”

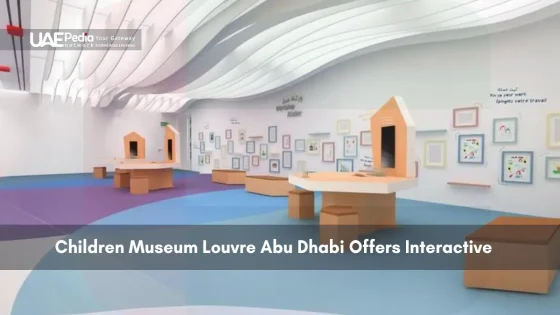

Experience the children museum louvre abu dhabi

Picture kneading clay into miniature falcon sculptures while your young artist debates color choices with a local potter. This isn’t a classroom—it’s where cultural discovery becomes collaborative play. The space thrives on workshops blending heritage crafts with modern tech, all designed for shared learning.

Family-Friendly Workshops and Cultural Engagement

Weekly sessions range from Emirati storytelling with augmented reality sandboxes to designing futuristic sadu patterns using light tables. “We’re not just preserving traditions—we’re letting kids remix them,” explains a workshop leader. One parent shared: “My daughter taught me about Bedouin weaving techniques… using glow-in-the-dark threads!”

Backed by the Department of Culture and Tourism, these programs bridge generations through tactile exploration. Think shadow-puppet theaters explaining lunar phases or 3D-printing stations reimagining ancient trade routes. Every activity layers educational content beneath vibrant creativity.

Three reasons families return:

- Rotating themes aligning with UAE cultural calendars

- Bilingual facilitators encouraging hands-on experimentation

- Take-home creations that extend the learning journey

Whether you’re local or visiting, these workshops turn observers into co-creators. As sunlight filters through geometric window screens onto laughing groups, you’ll witness curiosity becoming legacy—one glue-stick masterpiece at a time.

A Journey Through Art, Culture, and Scientific Wonders

Ever tried painting with starlight or solving puzzles using planetary orbits? This exhibition redefines discovery through four cosmic pillars: Contemplate, Narrate, Measure, and Explore. Each theme weaves Emirati heritage with scientific inquiry, creating a tapestry where Bedouin star navigation meets quantum physics.

Interstellar Themes: Contemplate, Narrate, Measure, and Explore

At the Measure station, touchscreens transform light-years into finger-swipe distances. Narrate zones let families craft stories using constellations as plot points. “It’s like rewriting Arabian Nights with nebulas as characters,” shares a recent visitor. Meanwhile, shadow puppetry at Contemplate corners reveals how ancient traders mapped skies.

Behind the Scenes with the Department of Culture and Tourism

Local astronomers and textile artists co-designed installations under the Department’s guidance. One team member explains: “We wanted exhibits that feel as boundless as desert horizons.” Their collaborations birthed features like magnetic sculpture walls mimicking asteroid collisions—a hit during evening adventure activities in the UAE for.

Interactive Play That Inspires Creative Learning

Glow-in-the-dark puzzle floors teach geometry through play. Tweens dissect color spectra using prismatic lenses, while toddlers chase projected comet trails. Every station adapts to curiosity levels—proof that culture tourism thrives when young visitors lead the exploration.

This space isn’t just about exhibits. It’s where art becomes a launchpad for questions, and science wears a smile. As sunlight filters through geometric screens onto laughing groups, you’ll witness imagination rewriting the rules of learning.

Embrace Adventures for Unforgettable Family Memories

Imagine a place where every wall whispers stories of the stars and ancient traditions come alive at your fingertips. Here, cosmic puzzles and glowing workshops turn curiosity into lifelong memories—all crafted with care by the Department of Culture and Tourism. This space isn’t just educational; it’s a playground where science dances with heritage.

Families bond over tactile challenges—like composing music from planetary motion or weaving light into digital sadu patterns. Young visitors leave with clay sculptures and constellations mapped across their imaginations. Even teens find wonder here, solving physics mysteries hidden in kinetic art.

Ready to transform your next outing? Pair this cultural gem with other UAE holiday activities for a trip that sparks joy across generations. Book your tickets early—adventures this vivid fill up faster than a sandstorm rolls across the dunes.

Bring home more than photos. Bring stories etched in stardust.

The space caters to young explorers aged 4–10, with exhibits scaled to spark curiosity across developmental stages. Activities adapt to different learning paces, ensuring toddlers and older kids alike find joy in discovery.

Absolutely! Seasonal workshops let families collaborate on art projects or science experiments—think crafting constellation maps or designing futuristic habitats. Check the Department of Culture and Tourism – Abu Dhabi’s calendar for themed events during festivals like Ramadan or Emirati Heritage Week.

Exhibits like “Picturing the Cosmos” merge astronomy and storytelling through tactile models and digital projections. Kids measure star distances, sketch alien landscapes, and listen to myths about the Milky Way—bridging creativity and critical thinking.

Yes! It’s open daily except Mondays. Pro tip: Arrive early to avoid crowds, especially during school breaks. Evening slots offer cooler temps and mesmerizing light play under Jean Nouvel’s iconic dome.

Snap away—most areas encourage photos! Some interactive installations even project visitor creations onto shared screens. Just avoid flash near delicate artifacts or during live performances.

Local traditions weave into activities—like designing patterns inspired by falaj irrigation systems or composing stories using Arabic calligraphy. The Department of Culture and Tourism ensures content honors heritage while embracing global perspectives.

Fuel up at Aptitude Café on-site, offering kid-friendly bites and Arabic coffee. For longer stays, Saadiyat Island’s beachfront eateries are a 5-minute drive away, serving everything from smoothie bowls to shawarma wraps.