Contents

Looking to compare term insurance UAE options? You’re in the right place. Term insurance in the UAE is a cost-effective way to protect your loved ones financially. You can get coverage up to AED 1 million for just AED 50 a month.

When you compare term insurance in the UAE, you’ll find clear terms. Most NRI plans offer tax-free claim amounts. This means your beneficiaries get the full amount without any deductions. Top providers like Zurich, MetLife, and Sukoon Insurance have plans for everyone.

Exploring the best term insurance options in the UAE shows many benefits. You can adjust coverage to fit your lifestyle. Whether you’re young, a parent, or self-employed, term insurance works for you. Experts say to get coverage that’s 10-15 times your annual income for the best protection.

Ready to find affordable term insurance in the UAE? Term insurance here gives you essential coverage without extra costs. It’s a wise choice for financial security and peace of mind in the UAE’s fast-paced world.

What is Term Insurance?

Term insurance is a key financial tool for expats and self-employed people in the UAE. It offers high coverage at low costs. This makes it a great choice for those looking for protection.

Definition and Overview

Term insurance gives life coverage for a set time, usually 5 to 35 years. It pays out if you die during the policy term. Unlike other insurances, it only offers protection, not investment.

Key Features of Term Insurance

When looking at term insurance in the UAE, consider these main points:

- Flexible term options (5-35 years)

- Affordable premiums, especially for the young

- High coverage amounts (up to 10-20 times annual income)

- Worldwide coverage in over 190 countries

- Simple and straightforward claims process

For those interested in critical illness coverage, many policies offer extra riders. These term insurance plans in Abu Dhabi and the UAE cover accidents, sickness, and COVID-19 from the start.

| Feature | Term Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | 5-35 years | Lifetime |

| Premiums | Lower | Higher |

| Death Benefit | Yes | Yes |

| Cash Value | No | Yes |

| Investment Component | No | Yes |

Knowing these features helps you choose the right term insurance in the UAE. Whether you’re an expat or self-employed, the right plan protects your loved ones financially.

Importance of Comparing Term Insurance

In the UAE, comparing term insurance plans is key for financial safety. The internet gives many choices for temporary term insurance comparison UAE. This makes it simpler to find the best coverage for you.

Understanding Your Coverage Needs

Before you start comparing online, think about what you need. Look at:

- How much money your family needs if you’re not there

- Any debts or loans you have

- Big expenses coming up, like education or retirement

- How long you want your policy to last (5 to 35 years in the UAE)

Evaluating Policy Benefits

Online tools help you see what different policies offer:

| Feature | Description |

|---|---|

| Coverage Amount | Starting from AED 1 million |

| Premium Cost | As low as AED 50 |

| Claim Settlement Ratio | 94% to 98% among UAE providers |

| Entry Age | Minimum 18, Maximum 65-79 years |

| Global Coverage | 190+ countries |

By looking at these details, you can pick a policy that protects you well and is affordable. The best term insurance is one that fits your budget and needs.

Factors to Consider When Comparing Plans

When looking at term insurance plans in the UAE, many important factors come up. A detailed long-term term insurance comparison UAE helps you choose wisely for your family’s financial safety.

Premiums and Payment Options

Insurance premiums change based on age, health, and how much coverage you want. Young people usually pay less because they are less likely to die. It’s key to have payment options that fit your life, like monthly or yearly.

Compare the costs to find the best deal for your money.

Policy Terms and Conditions

Look closely at policy details, like how long it covers you, what it doesn’t cover, and extra features. Extra coverage for serious illnesses can be helpful but might cost more. Think about term insurance that can change with your finances.

A family term insurance comparison UAE should look for policies that meet your long-term needs.

Claims Process

Check how different insurers handle claims. Choose ones with easy processes and high success rates. Also, make sure their customer service is good for a smooth claim process.

A quick term insurance comparison UAE should focus on insurers known for easy claims handling.

| Factor | Importance |

|---|---|

| Claim Settlement Ratio | Shows if they pay claims well |

| Solvency Ratio | Shows if they’re financially strong |

| Customer Service | Makes claims easy |

| Add-Ons and Riders | Let you customize |

Always check if your insurance still fits your needs, at least once a year or after big life changes. By looking at these points, you can pick a term insurance plan that protects you and your family well in the UAE.

Top Term Insurance Providers in the UAE

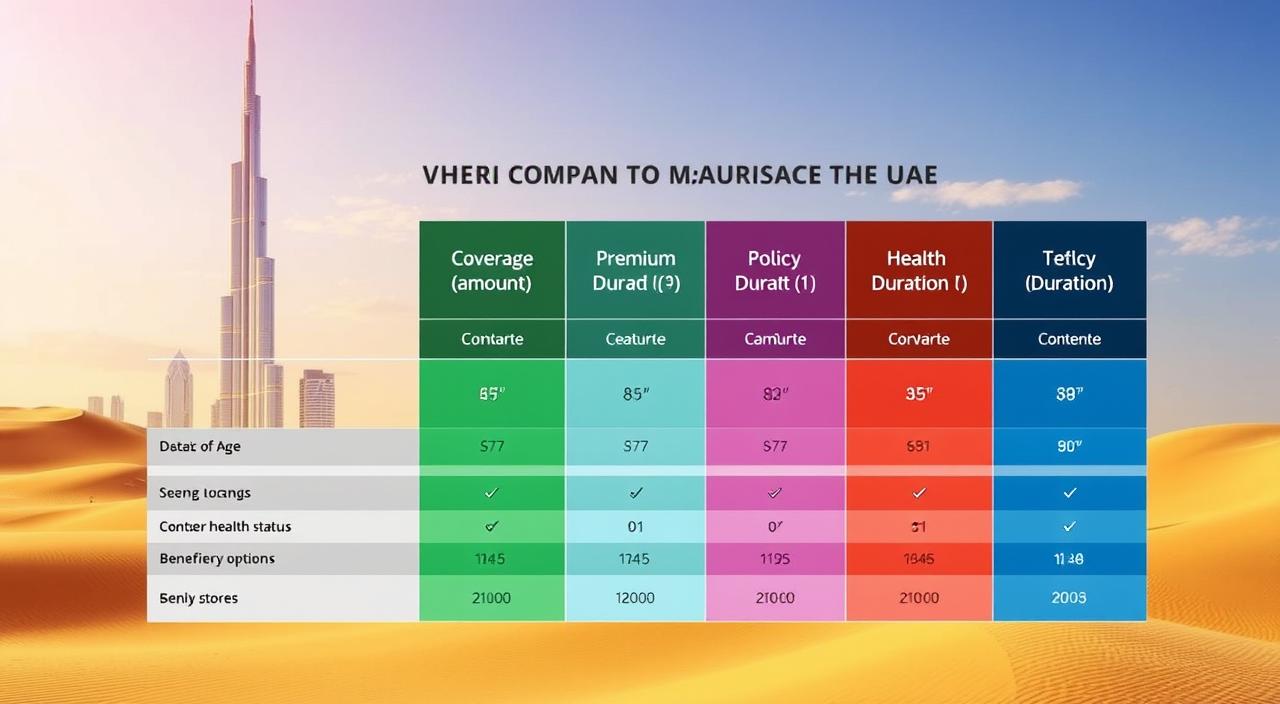

Looking for term insurance in the UAE? Knowing the top providers is key. The UAE has many options for term insurance.

Overview of Major Insurance Companies

In the UAE, top term insurance providers are Zurich International Life, MetLife, Friends Provident International, Oman Insurance, and Salama. Each has special features for different needs.

Unique Offerings and Features

Zurich International Life’s plan covers up to age 79. It lasts from 5 to 35 years. MetLife’s Live Life plan protects up to 30 years, until age 85.

Friends Provident International has affordable plans starting at $17.50 a month. This is great for short-term needs.

Oman Insurance’s LifeGuard plan doesn’t charge more for smokers. It covers ages 1 to 80. Salama’s Hemaya Plus is Sharia-compliant, covering up to age 100 with benefits for families.

| Provider | Unique Feature | Maximum Coverage Age |

|---|---|---|

| Zurich International Life | Critical illness benefit | 79 years |

| MetLife | Decreasing and level term options | 85 years |

| Salama | Sharia-compliant Takaful solutions | 100 years |

Your choice depends on your needs, budget, and goals. Always check the terms and conditions of each provider.

How to Compare Term Insurance Online

Now, comparing term insurance plans in the UAE is easy online. You can look at child, group, and full term insurance plans. This makes it simple to find what you need.

Utilizing Comparison Websites

Online comparison sites make it easy to check out term insurance plans. They let you see quotes from different insurers at once. You can easily compare coverage, premiums, and policy terms.

Tips for Effective Comparison

When you compare term insurance plans, keep these tips in mind:

- Coverage amount: Usually AED 1 million for most plans

- Premium rates: Start at AED 50 in the UAE

- Policy terms: Last from 5 to 35 years

- Claim settlement ratio: Choose insurers with ratios between 94% and 98%

- Additional benefits: Look for critical illness or permanent total disability coverage

Think about your age, health, and lifestyle when comparing plans. Don’t just look for the cheapest premium. Consider the value and coverage each plan offers.

| Insurer | Claim Settlement Ratio | Minimum Entry Age |

|---|---|---|

| HAYAH Insurance | 98.1% | 18 years |

| Sukoon Insurance | 97.5% | 18 years |

| Zurich Insurance | 97.9% | 18 years |

| Orient Insurance | 97.4% | 18 years |

By using these tips, you can find the best term insurance plan for you in the UAE.

Common FAQs About Term Insurance in the UAE

Looking for the best term insurance in the UAE? You might have questions. Term insurance is loved for its high coverage and low costs. It covers death from natural causes, accidents, and illnesses.

The coverage amount is usually 10 to 20 times your yearly income.

Some think term insurance gives money if you live past the policy term. But, it doesn’t. The policy term can be from 5 to 40 years, based on your age when you buy it. Buying at a younger age means lower premiums.

When comparing term plans in the UAE, remember riders add 5-10% to the policy cost. Riders include Permanent & Total Disability, Critical Illness Cover, and Accidental Death Benefit. Level term insurance has the same premium throughout, while decreasing term insurance lowers coverage each year.

Term insurance in the UAE doesn’t invest your money. Aim for 10 times your current income in coverage. Knowing these details helps you pick the best term insurance for you in the UAE.