Contents

- 1 Understanding Third-Party Car Insurance in the UAE

- 2 Benefits of Third-Party Insurance for Expats in the UAE

- 3 Car Accident Third-Party Claims Process in the UAE

- 4 Types of Vehicles Covered Under Third-Party Insurance

- 5 Luxury Vehicle and SUV Accident Claims in the UAE

- 6 Temporary and Short-Term Third-Party Insurance Options

- 7 Motorbike Accident Claims: Third-Party Coverage Specifics

- 8 Digital Revolution: Online Third-Party Claims in the UAE

- 9 Renewing Your Third-Party Insurance Policy

- 10 Comparing Third-Party and Comprehensive Insurance Claims

- 11 Third-Party Damage Claims: What’s Covered and What’s Not

- 12 Road Accident Liability: Understanding Your Rights and Responsibilities

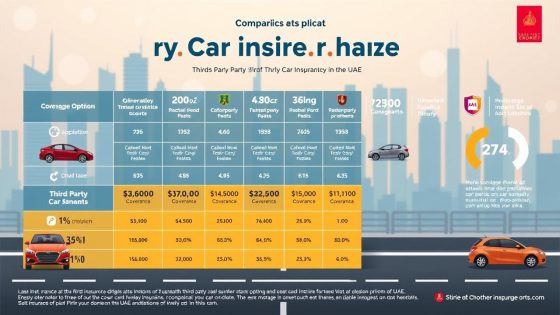

Driving in the United Arab Emirates needs third-party car insurance. It’s the legal minimum. This coverage helps you avoid big financial losses if you’re in an accident. Knowing about third-party accident insurance UAE policies is key for all drivers.

Third-party insurance in the UAE gives you a lot of protection. It covers injuries to others and damage to their property up to AED 3,500,000. This means you’re ready for most accident claims.

Many insurers offer easy online services for third-party insurance. You can buy or renew policies in just minutes. Some companies even have automated claims processing. This makes handling vehicle accident claims UAE faster and easier.

Some insurance providers offer more than the basics. They include personal accident protection for drivers and passengers, up to AED 200,000 each. They also offer 24/7 roadside assistance in the UAE and GCC countries.

When picking your insurance, look for extra perks. Some companies give online discounts or extra coverage options. These can include protection against natural disasters, fire, theft, and even off-road incidents in certain policies.

Understanding Third-Party Car Insurance in the UAE

Third-party car insurance is key for driving in the UAE. It’s a must for all car owners. It helps cover costs if you’re in an accident with someone else.

Definition and Legal Requirements

Third-party insurance helps if you hurt someone else while driving. In the UAE, it’s the law for all cars. It keeps you safe from big bills if you’re to blame in an accident.

Coverage Scope and Limitations

It’s vital to know what third-party insurance covers and what it doesn’t:

- Covers damages to third-party property

- Provides liability coverage up to AED 3.5 million

- Does not cover repairs to your own vehicle

- Excludes theft, fire, or natural disaster damage to your car

Importance for UAE Drivers

For UAE drivers, including expats, third-party insurance has many benefits:

- Meets legal requirements for vehicle ownership

- Provides financial protection against third-party claims

- Offers a cost-effective option for older vehicles

- Simplifies expat accident claims UAE processes

| Insurance Type | Coverage | Cost |

|---|---|---|

| Third-Party | Third-party damages only | Lower premiums |

| Comprehensive | Third-party and own vehicle | Higher premiums |

Benefits of Third-Party Insurance for Expats in the UAE

Third-party insurance is a great deal for expats in the UAE. It’s affordable and covers what you need. It’s perfect for those looking for cheap accident claims UAE options.

It’s especially useful for expats driving in the UAE. It covers injuries and damage to other people’s property. This keeps your money safe and follows UAE laws.

Many insurers offer extra benefits. You might get 24/7 roadside help in the GCC and UAE. You could also get money if you can’t use your car, depending on your policy.

| Benefit | Description |

|---|---|

| Legal Compliance | Meets mandatory insurance requirements in the UAE |

| Cost-Effective | Lower premiums compared to comprehensive insurance |

| Third-Party Coverage | Protects against liability for injury and property damage |

| Additional Services | Often includes roadside assistance and other benefits |

Looking for affordable accident claims UAE options? Third-party insurance is a smart choice. It’s a good mix of protection and cost for expats in their new home.

Car Accident Third-Party Claims Process in the UAE

Knowing how to handle car accidents in the UAE is important. It can save you time and stress. Here are the key steps to follow after a crash.

Immediate Steps After an Accident

Your safety is the most important thing. Move to a safe spot if you can. Check if anyone is hurt.

Call the police right away. In the UAE, you need a police report for insurance claims. Don’t leave the scene without reporting it. It could lead to legal trouble.

Documenting the Incident

While waiting for the police, start gathering evidence. Take photos of the damage. Get contact info from any witnesses.

Write down the time, date, and where the accident happened. This info is crucial for your insurance claim. It can make the process faster.

Contacting Your Insurance Provider

After getting the police report, call your insurance company. Many UAE insurers are available 24/7. They can be reached by phone or online.

Be ready to share details about the accident and your policy number. Some companies have special teams to help with claims.

| Step | Action | Importance |

|---|---|---|

| 1 | Ensure safety | Prevents further injuries |

| 2 | Call police | Legally required for claims |

| 3 | Document scene | Supports claim accuracy |

| 4 | Contact insurer | Initiates claim process |

By following these steps, you’ll handle car accidents in the UAE better. Quick action and detailed documentation are key. They help make the claims process smoother.

Types of Vehicles Covered Under Third-Party Insurance

In the UAE, third-party insurance covers many vehicles. This is a must-have for cars, SUVs, luxury cars, and motorcycles. The Insurance Authority Board of Directors’ Decision No. (25) of 2016 sets the rules for this insurance.

This policy helps with claims for accidents involving a third party. It covers injuries and damage to property. This protection is for accidents that happen inside or outside the vehicle.

Insurance policies for accidents can change based on the vehicle. Things like the vehicle’s age and engine size matter. The driver’s age and driving history also affect the cost. Some insurers offer extra coverage for expensive cars or motorcycles.

Here are some important things to know about third-party insurance:

- Covers liability for bodily injury and property damage

- Applies to various vehicle types including cars, SUVs, and motorcycles

- Compensation limits may apply for family members

- Prompt accident notification is required

- Additional coverage can be added through separate policies or riders

Knowing what third-party insurance covers is key. It helps with claims for accidents. This knowledge is important for handling vehicle accident claims UAE and navigating the accident insurance third-party UAE process.

Luxury Vehicle and SUV Accident Claims in the UAE

In the UAE, claims for luxury and SUV accidents need extra care. The Emirates’ high-end car market needs special insurance for these valuable cars.

Special Considerations for High-Value Vehicles

Luxury cars and SUVs have higher repair costs and more chance of damage to others. This means owners pay more for insurance. Some insurers offer special policies with up to AED 5 million for damage to others’ property.

Impact on Premiums and Coverage

Insurance costs for luxury cars vary a lot. For example, a 2021 Audi Q7 might cost between AED 3,500 and AED 8,000 for full coverage. The cost depends on the car’s age, value, and the driver’s history.

Many insurers give extra benefits for luxury cars:

- Personal injury coverage up to AED 30,000

- Emergency medical expenses up to AED 5,000 per accident

- Windscreen damage coverage up to AED 3,000 with no deductible

- Personal belongings coverage up to AED 5,000

SUV owners get special off-road coverage up to the policy’s limit. This is great for those who love desert driving. With these options, luxury and SUV owners in the UAE can keep their cars safe on and off the road.

Temporary and Short-Term Third-Party Insurance Options

In the UAE, you can find short-term third-party insurance for certain needs. It’s for visitors, those living here temporarily, and people leasing cars for a short time. Some insurance companies offer this flexible coverage.

Short-term third-party insurance in the UAE lasts from one to nine months. It has the same benefits as regular policies. This includes personal accident cover and roadside help. The process for making claims is the same as with regular insurance.

Benefits of temporary car insurance include:

- Lower monthly costs compared to traditional policies

- Instant coverage

- Protection against third-party property damage and injuries

- Personal accident cover for the driver

This insurance is great for many situations. It’s good for renting a car, learning to drive, or borrowing a vehicle. It’s also useful when planning to sell a car soon after buying it or traveling to another country.

When looking at short-term third-party insurance in the UAE, do your research. Compare prices, look at total costs, and make sure the policy fits your needs. Remember, while temporary insurance is flexible, you must always have the mandatory third-party liability coverage required by UAE law.

Motorbike Accident Claims: Third-Party Coverage Specifics

Motorcycle insurance in the UAE is different from car insurance. This is because motorcycles face unique risks. It’s important for riders to understand these differences to get the right protection.

Unique Aspects of Motorcycle Insurance

Insurance for motorcycles in the UAE looks at engine size and bike model. This is because motorcycles are riskier than cars. Some insurers offer special packages for riders. These packages give extra benefits beyond basic third-party coverage.

Claim Process Differences

The claim process for motorcycle accidents in the UAE is different. Riders need to provide detailed information about the accident. This includes photos of damage and witness statements.

Insurance companies also want a thorough check of the motorcycle. They need to see how much damage there is.

| Aspect | Car Insurance | Motorcycle Insurance |

|---|---|---|

| Risk Assessment | Based on car model and driver history | Considers engine size and bike model |

| Premium Calculation | Lower risk, generally lower premiums | Higher risk, often higher premiums |

| Claim Documentation | Standard accident reports | Additional motorcycle-specific details required |

| Coverage Options | Standardized packages | Specialized rider-focused policies available |

When you make a claim for a motorcycle accident in the UAE, act fast. Give your insurer all the information they need. This makes the claims process smoother and helps you get fair compensation for any damages or injuries.

Digital Revolution: Online Third-Party Claims in the UAE

The UAE insurance industry has moved into the digital age. This change has made handling online third-party claims easier and more efficient. It’s now simpler for policyholders across the country.

Insurance companies now have digital platforms for managing policies and filing claims. You can buy, renew, and file claims online. This makes it easy to check your policy and claim status anytime.

The UAE’s digital accident claims process is now simpler for drivers. Many insurers have mobile apps. These apps let you submit claims, upload photos, and talk to adjusters from your phone. This makes claims processing faster.

Key features of online third-party claims in the UAE include:

- Instant policy issuance upon premium payment

- Digital document submission

- Real-time claim tracking

- Direct communication with insurance representatives

The Insurance Authority’s rules support this digital change. Decisions No. 25 of 2016 and No. 42 of 2017 ensure online processes are as good as traditional ones. This protects your rights as a policyholder online.

Using digital accident claims UAE platforms saves time and hassle. It’s a modern way of doing insurance. It fits with the UAE’s goal for a tech-advanced future in all areas, including car insurance.

Renewing Your Third-Party Insurance Policy

Renewing your third-party insurance in the UAE is key for legal and financial safety. The renewal process is simple. But, knowing the timing, what you need, and how rates change is important.

Timing and Requirements

In the UAE, all drivers must have third-party liability insurance. Renewing your policy before it ends is crucial to keep coverage. You can buy policies up to 30 days early to save money and make registration easier.

Many insurers let you renew online. This makes the process quick and easy.

Factors Affecting Renewal Rates

Several things can change your renewal rates:

- Driver’s age and experience

- Claims history

- Location

- Vehicle value and type

The UAE’s Insurance Law protects you from rate hikes due to claims. This rule is the same for all insurers. It gives policyholders peace of mind.

Don’t forget to renew on time. If you don’t, you might have to pay for repairs yourself after an accident. Some insurers send reminders to help you remember.

Comparing Third-Party and Comprehensive Insurance Claims

Understanding the difference between third-party and comprehensive insurance in the UAE is key. This guide will help you choose the right insurance for you.

Third-party insurance is the basic, required coverage in the UAE. It protects you from financial loss if you damage someone else’s property or hurt someone in an accident. But, it doesn’t cover damage to your own car.

Comprehensive insurance, on the other hand, offers full accident coverage UAE. It includes everything third-party insurance does, plus protection for your car against theft, fire, and natural disasters. This makes it a more complete insurance option.

| Feature | Third-Party Insurance | Comprehensive Insurance |

|---|---|---|

| Cost | Lower premiums | Higher premiums |

| Coverage | Third-party damages only | Third-party and own vehicle damages |

| Add-ons | Limited options | Multiple add-ons available |

| Claim Process | Simpler for third-party claims | More complex, includes own vehicle assessment |

| No Claim Bonus | Not applicable | Available during renewals |

Third-party insurance is cheaper and good for old cars or those who don’t drive much. But, comprehensive insurance offers more peace of mind with its wide coverage. Your choice depends on your needs and how much risk you’re willing to take in the UAE’s driving environment.

Third-Party Damage Claims: What’s Covered and What’s Not

Third-party damage claims in the UAE are very important for drivers. They protect against damage to others’ property and injuries in accidents. It’s key for all car owners in the Emirates to know what’s covered.

Property Damage Coverage

In the UAE, third-party insurance covers up to AED 3.5 million for property damage. This includes fixing or replacing other vehicles or buildings damaged in an accident. It helps you avoid big costs for damages you might cause.

Bodily Injury Liability

Bodily injury coverage is a big part of third-party damage claims in the UAE. It pays for medical bills and legal costs if you hurt someone else. If someone dies, the insurance pays out to their family based on court rules.

| Covered | Not Covered |

|---|---|

| Third-party property damage | Damage to insured vehicle |

| Third-party bodily injuries | Personal injuries to policyholder |

| Legal costs for third-party claims | Theft or natural disaster losses |

Third-party insurance doesn’t cover your car’s damage or your injuries. It’s meant to protect others from financial harm you might cause. For full protection, think about getting more coverage.

Road Accident Liability: Understanding Your Rights and Responsibilities

In the UAE, knowing your rights and duties in road accidents is crucial for third-party claims. If a crash happens, tell the police and your insurer right away. This is very important for third-party cases in the UAE.

Your third-party cover helps with legal costs but not personal losses. UAE law makes car owners responsible for accidents, even if someone else drives. Employers are liable for work-related crashes in company cars.

Parents might face charges for accidents caused by their young drivers. Lending your car to risky drivers can also make you responsible. In shared fault crashes, both sides might share the blame.

Factors like care level, fault share, and insurance play a role. Police reports, witness stories, and crash proof shape who’s at fault. These elements affect accident claims in the UAE.

Knowing local traffic rules and insurance laws is important. Some UAE insurers offer legal help with third-party plans. This aid can guide you through your rights and duties after a crash.