Contents

- 1 Understanding Premium Car Insurance in Dubai

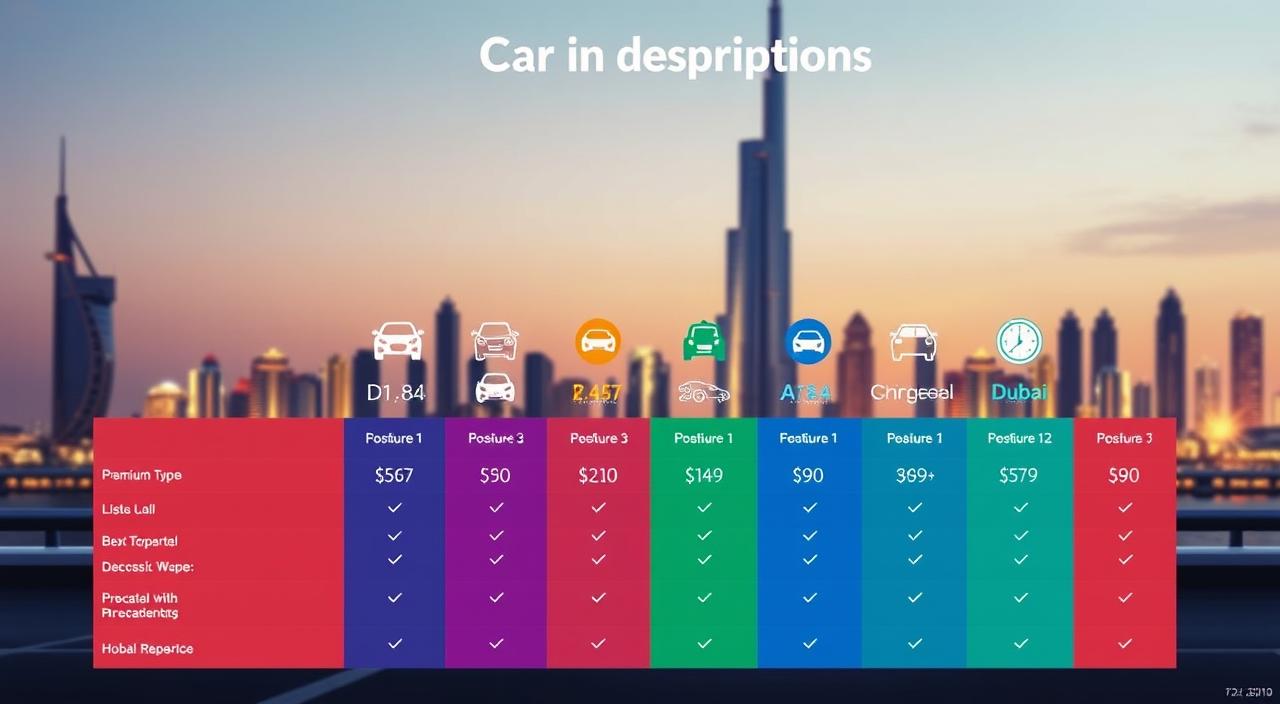

- 2 Types of Premium Car Insurance Plans in Dubai

- 3 Key Features of Premium Car Insurance Plans

- 4 Factors Affecting Premium Car Insurance Rates in Dubai

- 5 Dubai Premium Insurance: Tailored Coverage for Luxury Vehicles

- 6 How to Choose the Best Premium Car Insurance Plan in Dubai

- 7 Top Premium Car Insurance Providers in Dubai

- 8 Benefits of Buying Premium Car Insurance Online

- 9 Add-on Coverages for Premium Car Insurance Plans

- 10 Premium Car Insurance Claims Process in Dubai

- 11 Cost-Saving Tips for Premium Car Insurance in Dubai

- 12 Importance of Reviewing Your Premium Car Insurance Policy Regularly

Insuring your luxury vehicle in Dubai needs the best coverage. Dubai premium insurance gives top protection for high-end cars. It covers loss or damage, third-party liability, personal injury, and emergency medical support.

Top insurers like Sukoon Insurance and RAK Insurance offer great policies in Dubai. They know luxury car owners need special coverage. With Dubai premium insurance, your car is safe from many risks.

Looking for the right premium car insurance in Dubai? Compare quotes and think about what you need. Your car’s make, your driving history, and how much protection you want matter. Choose a good plan to feel safe while driving your luxury car in the UAE.

Understanding Premium Car Insurance in Dubai

Premium car insurance is key for protecting your high-value vehicle in Dubai. It offers extra coverage and benefits for luxury and high-performance cars. With a premium vehicle policy in the UAE, you’ll know your car is safe from many risks.

What is Premium Car Insurance?

Premium car insurance is made for high-value vehicles. It protects against damage, theft, and third-party claims. These policies have higher limits and extra features than standard insurance. A premium accident protection plan in Dubai means your vehicle is safe in unexpected situations.

Benefits of Premium Car Insurance

Getting a premium car insurance policy in Dubai has many benefits. These include:

- Higher coverage limits to protect your high-value vehicle

- Additional features like roadside assistance and off-road coverage

- Personalized service and dedicated support

- Free pick-up and drop-off for car servicing

- Free airport pick-up and drop-off concierge service

- Free car inspection pick-up and drop-off for registration renewal

When looking for premium coverage quotes in the UAE, compare different insurers. This helps find the best plan for your needs and budget. With a Dubai premium vehicle protection policy, you can drive confidently, knowing your luxury car is fully covered.

| Coverage Type | Annual Premium Range |

|---|---|

| Comprehensive Car Insurance | AED 1,200 – AED 5,000 |

| Third-Party Car Insurance | AED 450 – AED 1,000 |

Types of Premium Car Insurance Plans in Dubai

In Dubai, you can choose from two main car insurance plans: comprehensive and third-party liability. Each offers different protection levels. This lets you pick the best plan for your needs and budget.

Comprehensive Premium Car Insurance

Comprehensive plans give the most coverage for your car in Dubai. They protect against accidents, theft, fire, and natural disasters. These plans also include extra features like:

- Personal accident cover for the driver and passengers

- Emergency medical expenses

- 24-hour roadside assistance

- Replacement car during repairs

- Off-road coverage for SUVs

GIG Gulf’s Motor Prestige plan covers personal injury up to AED 20,000. Their Motor Perfect policy offers up to AED 20,000 for personal and medical protection. When looking for online car insurance in the UAE, compare each insurer’s comprehensive plans. This helps you find the best one for you.

Third-Party Premium Car Insurance

Third-party plans are more basic. They protect you from legal liabilities in accidents. If you’re at fault, this policy covers costs up to a certain limit.

In Dubai, third-party plans offer liability coverage from AED 1 million to AED 3.5 million. Some, like GIG Gulf, offer extra benefits. These include Oman coverage or personal accident benefits up to AED 200,000.

| Insurer | Policy Type | Annual Premium (Honda City EX 1.5L, 2017) |

|---|---|---|

| Sukoon Insurance | Comprehensive | From AED 1,470 |

| RAK Insurance | Comprehensive | From AED 1,550 |

| Sukoon Insurance | Third-Party | From AED 630 |

| RAK Insurance | Third-Party | From AED 680 |

Choosing between comprehensive and third-party plans depends on several factors. Consider your vehicle’s value, your risk level, and your budget. Third-party plans are cheaper but might not cover luxury or high-value cars well. The right plan for you depends on your specific needs and priorities.

Key Features of Premium Car Insurance Plans

Premium car insurance plans in Dubai offer many key features. They provide high coverage limits, agency repair options, and 24/7 roadside assistance. These features ensure you and your vehicle are safe in emergencies.

One great feature is the high coverage limits. For example, GIG Gulf’s Motor Prestige plan covers up to AED 5 million for third-party liability. It also covers up to AED 20,000 for personal injury and AED 6,000 for emergency medical support. This means you and your passengers are well taken care of in accidents.

Another important feature is the option for agency repairs. If your vehicle is damaged, it can be fixed at the manufacturer’s authorized workshop. This ensures your vehicle’s value and performance are maintained.

| Insurance Provider | Key Features |

|---|---|

| GIG Gulf Motor Prestige |

|

| SALAMA Takaful |

|

| Noor Takaful |

|

Premium car insurance plans also offer personal belongings protection. This covers the cost of replacing or repairing lost, stolen, or damaged personal items. This includes laptops, mobile phones, and jewelry, adding extra protection for your valuables.

Many premium plans in Dubai offer digital premium insurance. This allows you to manage your policy online. You can renew your policy, submit claims, and access your policy documents anytime, anywhere.

Other notable features include off-road coverage, Oman coverage, and a no-claims discount. These rewards safe driving habits. Temporary premium insurance options are also available for short-term needs.

Factors Affecting Premium Car Insurance Rates in Dubai

Premium car insurance rates in Dubai depend on many things. Insurance companies look at these factors to figure out how risky it is to insure your car. Knowing these can help you pick the best insurance plan for you.

Vehicle Make and Model

The type of car you have affects your insurance rates. Luxury and sports cars cost more to insure because they’re pricey to fix and might be involved in serious accidents. Newer cars need more coverage, and cars with strong engines or special parts cost more to insure too. A car insurance calculator in Dubai shows how your car’s details affect your premium.

Driver’s Age and Experience

Your age and how long you’ve been driving matter a lot. Young drivers, especially those under 25, pay more because they’re seen as riskier. They’re more likely to be in accidents because they’re new to driving. But, older drivers with clean records get lower rates. Your nationality and how long you’ve had a UAE driver’s license also play a part.

Driving History and Claims

Your driving record and claims history greatly affect your rates. If you’ve had accidents or traffic tickets, you’ll likely pay more. But, if you’ve never had a claim, you might get a discount. When looking at insurance quotes, make sure to give accurate info about your driving history.

Remember, these are just some of the things that affect your rates. Other things like the coverage you choose and the insurance company’s reputation also matter. By understanding these and using a car insurance calculator, you can find a plan that fits your needs and budget in Dubai.

Dubai Premium Insurance: Tailored Coverage for Luxury Vehicles

Insuring your luxury car in Dubai needs more than a standard policy. Dubai premium insurance offers special coverage for high-end vehicles. This includes cars like Rolls Royce, Bentley, Ferrari, and others worth over AED 500,000.

Choosing a premium car insurance plan in Dubai lets you customize your coverage. Insurers like Sukoon have special packages, like the Privilege Club. This offers high limits and a unique claims process for luxury car owners. You can also use online tools to compare plans and find the best value.

Premium insurance plans in Dubai include extra covers and benefits. For example, Sukoon’s Premier Cover offers 24/7 roadside help across the GCC and UAE. It also includes premium garage services for repairs. Other benefits include courtesy cars, off-road cover, and personal accident coverage.

| Coverage Type | Key Features |

|---|---|

| Elite Motor Insurance Package | Designed for vehicles valued at over AED 500,000, focusing on luxury brands such as Rolls Royce, Bentley, Ferrari, McLaren, Aston Martin, Bugatti, and Lamborghini. |

| Privilege Club | Offers high limits, a unique claims process, and priority service to its members who insure luxury vehicles. |

| Premier Cover | Includes features such as roadside assistance 24×7 across GCC and UAE and exceptional services at premium garages for non-agency repairs. |

| Standard Covers | Includes unlimited agency repairs, third party property damage coverage up to AED 5,000,000, and bodily injury coverage as determined by the UAE court. |

| Additional Covers | Consists of benefits like courtesy car up to AED 10,000, off-road cover for 4×4 vehicles, and personal accident coverage for drivers and passengers up to AED 200,000. |

For expats in Dubai, premium car insurance is very helpful. These policies consider expats’ unique needs. They offer comprehensive coverage, including repatriation coverage for emergencies.

When looking for premium car insurance in Dubai, choose a reputable insurer. They specialize in luxury vehicles and offer the best protection. This way, you can drive with peace of mind, knowing you’re covered.

How to Choose the Best Premium Car Insurance Plan in Dubai

Looking for the best car insurance in Dubai? Start by taking a careful look at what you need. Compare quotes and read policy details to make a smart choice. This way, you get the best protection for your car.

Assess Your Coverage Needs

First, think about what you need from your car insurance. Consider your car’s make, value, and how you drive. Decide on the coverage you want, like for accidents or breakdowns. Knowing what you need helps you find the right plan.

Compare Quotes from Multiple Insurers

Get quotes from different insurers to find the best deal. Use online tools to compare easily. Look at the cost, what’s covered, and any extra benefits. Ask for help from brokers to find the best offer.

| Insurance Provider | Google Business Profile Rating | Key Features |

|---|---|---|

| AXA Insurance | 4.5 | Comprehensive coverage, 24/7 roadside assistance, agency repairs |

| RSA Insurance | 4.3 | Customizable plans, fast claim settlement, personal accident cover |

| Oman Insurance Company | 4.2 | Competitive rates, no claims discount, off-road coverage |

| Noor Takaful | 4.4 | Sharia-compliant policies, emergency medical expenses, GCC cover |

Review Policy Terms and Conditions

Before you choose, read the policy details carefully. Check for any exclusions or limits. Know how to make a claim and what documents you need. This helps you avoid surprises later.

Choosing the right car insurance in Dubai takes time and effort. By doing your research, you can find a plan that’s right for you. With the right insurance, you can drive with confidence in the UAE.

Top Premium Car Insurance Providers in Dubai

In Dubai, several top car insurance providers stand out. They offer great coverage, service, and are financially stable. Sukoon Insurance, RAK Insurance, Watania Takaful Insurance, Salama Insurance, Tokio Marine Insurance, GIG Gulf Insurance, and Alliance Insurance are among the best.

Sukoon Insurance is a big name in the market. It pays out AED 2 billion in claims each year and has a customer satisfaction rate of 86%. With a team of about 700, Sukoon offers many insurance types, including car insurance.

GIG Gulf Insurance has over 70 years of experience. It’s trusted by millions for its clear claim process. GIG offers car insurance packages that cover up to 15 years and include extra benefits.

Watania Takaful Insurance has car insurance plans with 24-hour roadside help and no claims discount. Salama Insurance, the oldest Takaful in the UAE, offers flexible no claim bonuses and instant policy issuance.

Tokio Marine Insurance is known for its strong finances. It has an A+ rating from Standard & Poor’s and an Aa3 rating from Moody’s as of April 2020. This means it can handle claims well.

| Insurance Provider | Key Features |

|---|---|

| Sukoon Insurance | Pays AED 2 billion in claims annually, 86% customer satisfaction rate, offers health, life, and property insurance |

| GIG Gulf Insurance | Over 70 years of experience, transparent claim processes, coverage up to 15 years, optional driver and passenger cover |

| Watania Takaful Insurance | Comprehensive plans with 24-hour roadside assistance and no claims discount |

| Salama Insurance | Oldest Takaful insurer in UAE, flexible no claim bonus, instant policy issuance |

| Tokio Marine Insurance | A+ rating from Standard & Poor’s, Aa3 rating from Moody’s, solid financial standing |

When picking a car insurance in Dubai, look at the company’s finances, claim process, and what others say. With 50% of car owners in Dubai having been in accidents in the last five years, good insurance is key. It keeps you safe and financially secure on the roads.

Benefits of Buying Premium Car Insurance Online

In today’s world, buying car insurance online in Dubai is very popular. Sites like Policybazaar UAE have changed how we buy insurance. They make it easier, faster, and cheaper.

Buying digital insurance in Dubai is super convenient. You can look at different plans from home. No need to go to insurance offices. This saves you time and effort.

Choosing online car insurance in the UAE lets you see many insurers and plans. You can compare them easily. This helps you pick the best coverage for your needs and budget.

| Benefit | Description |

|---|---|

| Convenience | Buy insurance from anywhere, anytime |

| Easy comparison | Compare multiple plans and prices quickly |

| Time-saving | No need for physical visits to insurance offices |

| Cost-effective | Online plans often come with discounts and offers |

| Paperless process | Digital policy documents, reducing paperwork |

Buying car insurance online can also save you money. Online providers have lower costs. They offer better prices without losing quality.

Online insurance makes everything easier. From getting quotes to managing your policy, it’s all online. No more paper or long waits.

In short, online car insurance in Dubai or the UAE is a great choice. It’s convenient, saves money, and makes things easier. It’s smart for car owners who want good coverage.

Add-on Coverages for Premium Car Insurance Plans

Premium car insurance plans in Dubai offer many add-on coverages. These add-ons let you customize your policy to fit your needs. They ensure you have full coverage in different situations.

Personal Accident Cover

Personal Accident Cover is very popular. It pays out a fixed amount for injuries. This includes medical costs, accidental death, and driver disability. It covers both the driver and passengers.

Roadside Assistance

Roadside Assistance is key in the UAE’s harsh weather. It helps with tire punctures, car lockouts, fuel shortages, and battery issues. With 24/7 support, help is always just a call away.

Off-Road Coverage

Off-Road Recovery Cover is great for those who love dune bashing. It protects your vehicle in off-road adventures. This ensures you’re safe during your off-road fun.

Other notable add-on coverages include:

- Natural Calamity Cover: Protects against losses from floods, hurricanes, storms, sandstorms, and earthquakes.

- Replacement of Vehicle: Gives you a replacement vehicle while your car is being fixed or repaired.

- Oman Cover: Expands your car insurance to include coverage in Oman.

| Add-on Coverage | Key Benefits |

|---|---|

| Personal Accident Cover | Fixed payout for injuries, medical expenses, accidental death, and driver disability |

| Roadside Assistance | 24/7 support for tire punctures, car lockouts, fuel shortages, and battery drainage |

| Off-Road Coverage | Protection for vehicles driven in off-road conditions, such as desert safaris |

| Natural Calamity Cover | Coverage against losses from floods, hurricanes, storms, sandstorms, and earthquakes |

| Replacement of Vehicle | Access to a replacement vehicle while your car is being serviced or repaired |

| Oman Cover | Extension of car insurance policy coverage to include Oman |

Choosing the right add-on coverages for your premium car insurance plan gives you peace of mind. You and your vehicle are protected against many risks in Dubai.

Premium Car Insurance Claims Process in Dubai

Filing a claim for car insurance in Dubai is easy. You just need to report the incident, tell your insurer, and send the needed documents. With quick claims premium Dubai, you get fast and easy claim settlements.

The first thing to do is report the incident to the police and get a police report. This report is key to proving your claim and figuring out who was at fault. After getting the report, tell your insurance company right away.

Most car insurance providers in Dubai let you start a claim in different ways. You can use online portals, mobile apps, or call their customer service. Pick the method that works best for you and give them your policy number, vehicle info, and when and where the incident happened.

You’ll need to send in some documents to support your claim. These might include:

- Police report

- Driver’s license

- Vehicle registration

- Repair estimates

Your insurer will then check your claim and tell you how much they’ll pay or if they’ll fix your car. Many plans offer fast claim settlements and cashless repairs at garages they work with. This makes the process smooth.

Motorbike insurance in the UAE also has a similar claims process. But, the exact needs and times can change based on the insurer and your policy.

| Step | Action |

|---|---|

| 1 | Report the incident to the police and obtain a police report |

| 2 | Notify your insurance provider |

| 3 | Submit required documents (police report, driver’s license, vehicle registration, repair estimates) |

| 4 | Insurer assesses the claim and communicates settlement amount or repair approvals |

| 5 | Cashless repair at network garage or reimbursement of expenses |

To make the claims process go smoothly, know your policy well, keep good records, and talk to your insurer quickly. By understanding the claims process and using your insurance plan’s benefits, you can reduce the cost of an accident and get back driving fast.

Cost-Saving Tips for Premium Car Insurance in Dubai

In Dubai, you can save on your car insurance costs. A car insurance premium calculator can show you how much you can save. Here are some ways to cut down on your insurance costs:

Install Safety and Anti-Theft Devices

Adding safety features like airbags and ABS can lower your insurance. These features make your car safer and less likely to be stolen. Insurance companies give discounts for cars with these systems.

Maintain a Clean Driving Record

Your driving record affects your insurance rates. A clean record means lower rates and discounts. Insurance companies in Dubai reward safe drivers with lower premiums.

Choose a Higher Voluntary Excess

Choosing a higher voluntary excess can lower your premium. This means you share more of the risk with the insurer. But, make sure you can afford the excess if you need to make a claim.

| Cost-Saving Measure | Potential Premium Reduction |

|---|---|

| Installing Safety and Anti-Theft Devices | Up to 20% |

| Maintaining a Clean Driving Record | Up to 30% |

| Choosing a Higher Voluntary Excess | Up to 15% |

Other ways to save on car insurance in Dubai include:

- Comparing quotes with a car insurance calculator

- Bundling car insurance with home insurance

- Paying annually instead of monthly

- Choosing a car with good safety ratings

By using these tips and a premium protection calculator, you can find affordable car insurance in Dubai. This will meet your budget and coverage needs.

Importance of Reviewing Your Premium Car Insurance Policy Regularly

It’s key to check your car insurance policy in Dubai often. This ensures you have enough coverage and aren’t paying too much. As your car gets older and loses value, you might need to change your coverage amount.

Changes in how you drive, adding new drivers, or installing safety features can also affect your premium. By looking at other top car insurance plans in Dubai, you might find ways to save or get better coverage.

Think about your driving experience and history when reviewing your policy. These things can really change how much you pay for insurance. Keeping a clean driving record and using safety features like GPS can help lower costs.

Regular car maintenance can also lower accident risks and your insurance costs. It’s important to check your policy at least once a year and before it’s up for renewal. This way, you can make sure your coverage fits your needs in Dubai.

Stay informed about the best car insurance plans in Dubai. Comparing different options can help you find the right one for you. If you need help, talk to your insurance company or a trusted broker. They can guide you on updating your policy in Dubai.