Do you dream of starting a business in the UAE? Are you curious about free zones? These special areas are like a secret path to success. They offer many benefits.

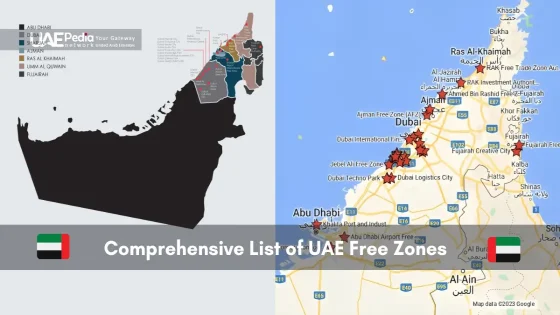

With over 45 free zones in the Emirates, the choices are vast. But, where do you start? Our guide will help you unlock your business success in the UAE!

Learn about the main benefits and how to set up your business. Whether you want Dubai’s bright lights or Abu Dhabi’s strong economy, there’s a free zone for you. Let’s start your journey to making your UAE business dreams come true!

Understanding UAE Free Zones: Benefits and Opportunities

UAE free zones are like a treasure chest for your business. They offer tax breaks and let you own your company fully. These zones are made to help your business grow.

Tax Benefits and Financial Advantages

Free zones in the UAE have great tax benefits. You won’t pay corporate tax, import duties, or personal income tax for a while. With new tax rules, knowing how to use these zones is key to save money.

100% Foreign Ownership Benefits

UAE free zones let you own your company fully. You don’t need a local partner. This makes starting a free zone business incorporation UAE or free zone company formation UAE easy for entrepreneurs.

Strategic Location and Infrastructure

UAE free zones are in great spots for your business. They have top-notch infrastructure and easy access to ports. Places like DMCC and Dubai Internet City are perfect for different industries.

| Free Zone | Key Focus | Advantages |

|---|---|---|

| DMCC | Commodity trading and services | Duty-free imports, 100% foreign ownership, tax exemptions |

| Dubai Internet City | Information technology and digital services | Streamlined setup, access to talent pool, collaborative ecosystem |

| Jebel Ali Free Zone (JAFZA) | Logistics, manufacturing, and trading | Strategic location, world-class infrastructure, simplified procedures |

Looking to business setup requirements free zones UAE or want to know about business setup fees free zones UAE? These free zones are full of chances for your business to succeed in the Middle East.

Free Zone Business Setup Guide: Step-by-Step Process

Are you ready to start your business in a UAE free zone? It’s going to be an exciting adventure! The steps are easy and can be done in a few weeks. Let’s explore the main steps to start your free zone business:

- Choose Your Free Zone: There are over 40 free zones in the UAE, each for different industries. We’ll help you find the best one for your business later.

- Decide on Your Company Type: You can choose between a Free Zone Limited Liability Company (FZ LLC) or a Free Zone Establishment (FZE). FZ LLCs are more flexible, while FZEs are good for single-owner businesses.

- Secure Your Trade Name: Make sure your trade name is approved. Avoid names that might cause trouble with the authorities.

- Apply for Your Business License: It usually takes 30-60 days to get your license. Some industries need extra approvals first.

- Find Your Office Space: Free zones offer various office options. You can even find temporary spaces to start quickly.

- Open a Corporate Bank Account: This is key for managing your business. The free zone can help you open a local bank account.

- Obtain Your Visas: Free zone businesses can get visas for employees and their families. This makes it easy to build your team.

With services like Bashr, you could start in just 15 minutes! Even if you’re not in the UAE, the Dubai Virtual Commercial City Program can help. So, let’s start this step by step business setup free zones UAE journey!

| Key Steps | Timeline |

|---|---|

| Choose Free Zone and Company Type | 1-2 weeks |

| Secure Trade Name and Apply for License | 30-60 days |

| Find Office Space and Open Bank Account | 2-4 weeks |

| Obtain Visas and Commence Operations | 1-2 weeks |

With this business setup timeline free zones UAE, you’ll be ready to grow your online business setup free zones UAE. And if you need free zone business support UAE, we’re here for you!

Selecting the Right UAE Free Zone for Your Business

Finding the right UAE free zone is like finding a cozy home. Each emirate has its own free zones for different industries. Let’s look at what to consider to find the best free zone for your business.

Major Free Zones by Emirate

Dubai is known for its free zones. You have places like the Dubai Multi Commodities Centre (DMCC) for trading, Dubai Internet City (DIC) for tech, and Dubai Media City (DMC) for media. Abu Dhabi has free zones for finance and green tech, like the Abu Dhabi Global Market (ADGM) and Masdar City. Sharjah offers affordable options with good transport links.

Industry-Specific Free Zones

UAE free zones focus on specific industries. Dubai Healthcare City (DHCC) is for health and wellness. Dubai Design District (D3) is for fashion and design. Picking a free zone that matches your industry can give you big benefits, like access to a skilled workforce and special support.

Cost Comparison Across Free Zones

| Free Zone | Average Office Space Cost (per sq. ft.) | Visa Quota (per 200 sq. ft.) |

|---|---|---|

| DMCC | $25 – $35 | 4-5 |

| DIC | $30 – $40 | 4-5 |

| ADGM | $45 – $55 | 4-5 |

| Sharjah Airport International Free Zone | $15 – $25 | 4-5 |

When comparing free zones, think about office space costs, visa quotas, and what’s available. This helps you find a good balance between your budget and your business needs.

Business Licensing and Company Formation Requirements

Starting a business in the UAE’s free zones has many steps. You can choose from many licenses. These include industrial, commercial, and even agricultural or occupational licenses.

You can also have more than one activity under one license. This makes it easier to grow your business.

When picking your company structure, you have many options. You can choose from limited liability companies (LLCs) to branches. Just remember, your company name must follow certain rules. No religious names or names already taken are allowed.

After getting initial approval, the real work starts. But don’t get discouraged. Keep moving forward, and you’ll set up a successful business in the UAE.

| Key Requirement | Details |

|---|---|

| Tax Benefits | The UAE has a zero percent corporate and personal income tax rate. The only exception is a 5% value-added tax (VAT). |

| Free Zone Packages | Free zone company setups offer many benefits. These include visa eligibility, co-working facilities, and more. |

| License Application | Licenses in free zones can be applied for directly. Many initial applications are completed online. |

| Documentation | You’ll need to provide passport copies, visas, a No Objection Certificate, and a business plan. |

| Visa Processing | The visa application process includes submission, medical tests, and biometric capturing. |

| Setup Costs | Costs vary based on location, premises, and visas needed. Discuss packages with a free zone company for a quote. |

Whether you’re setting up a business setup in Abu Dhabi, company formation in Dubai, or exploring business registration and business incorporation options across the UAE, understanding the business support available in free zones is crucial for your success.

Legal Structure and Documentation Process

Starting a business in a UAE free zone needs careful planning. First, pick the right legal structure for your company. This could be a sole proprietorship, partnership, LLC, or corporation. Your choice depends on your business, the number of owners, and your future plans.

After choosing your legal structure, you’ll need to get the right documents. You’ll need a Memorandum of Association (MoA) or a Local Service Agent Agreement (LSA). You’ll also need proof of your business address in the free zone. Depending on your business, you might need extra approvals from government bodies.

Visa Processing Requirements

One great thing about UAE free zones is the easy visa process. Free zones give you visas for your owners, shareholders, and employees. This makes it simple to bring in the right people. The visa application is easy and the free zone’s team can help you.

Corporate Bank Account Setup

The last step is opening a corporate bank account. This helps you manage your company’s money. Free zones often work with local banks, making it easy to open an account. Just remember to have your company registration and passport copies ready.

By following the legal and documentation steps, you can start your free zone company easily. With the right help, you’ll be making money in no time!

Conclusion

And there you have it, folks – your ticket to free-trade zone success! The UAE’s free zones offer big perks like 100% foreign direct investment. They also have great tax benefits.

The trade and investment world is always changing. But, with the right knowledge, you can still get that 0% tax rate. Each free zone is different, so choose the one that fits your business best.

The UAE’s free zones are ready for you. They offer easy setup, great locations, and lots of chances to grow. So, what are you waiting for? Let’s start your free zone dream today!

Looking to export or use the Jebel Ali free-trade zone? The UAE is full of chances. Find the free zone that matches your company‘s needs. With some research and planning, you’ll unlock the UAE’s business world.

So, what are you waiting for? Begin your free zone journey today. The UAE’s business world is full of opportunities. Just take that first step.